Databricks, a cloud-based big data analytics platform, is planning to go public. The company, which was co-founded by the creators of Apache Spark, has become increasingly popular in recent years as more companies turn to cloud-based data analytics solutions. In this blog post, we'll explore what the Data Bricks IPO means for the future of big data analytics.

6 Hot IPOs to Watch Out for in 2023

Overview

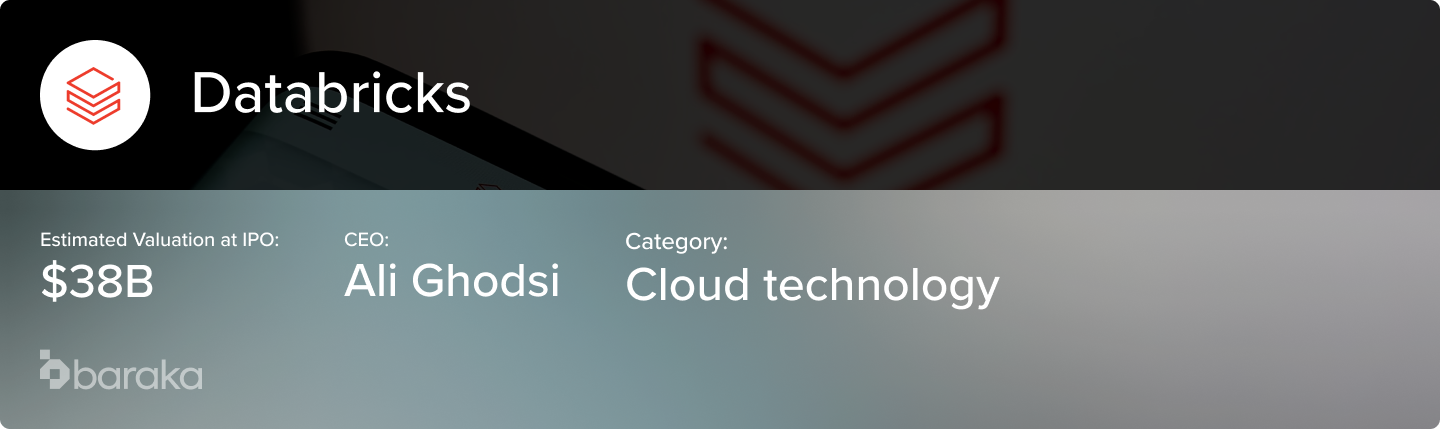

Founded in 2013 by Swedish-Iranian computer scientist Ali Ghodsi, alongside the creators of Apache Spark, Databricks is a San Francisco-based company that provides AI-powered data analytics. It operates in over 20 countries worldwide and has developed a range of open-source projects related to data science, data engineering, and machine learning, including Delta Lake, MLflow, and Koalas. Its platform, hosted in the Cloud, enables large organizations to manage their own data.

The company’s new data warehousing method known as "lakehouse" cloud architecture merges immense amounts of unrefined data or “lakes” with structured data structures or “warehouses”, helping businesses to manage their data with a single data and AI platform. This modern approach to data storage and analysis aims to revolutionize the way data is managed and render traditional methods of data warehousing obsolete.

In the same year, the company secured $13.9 million in initial funding and in 2014, they successfully raised $33 million in Series B funding. This enabled them to hire new staff and launch their Databricks Cloud. Over the next five years, their user base expanded to around 5,000 companies and they received $850 million in investments, mainly from Andreessen Horowitz. In 2019, they raised $400 million, which allowed them to increase their R&D and international plans. In 2021, they obtained $2.6 billion in funding to develop their 'Data Lakehouse' and their revenues totaled $425 million, with approximately 2,000 employees.

When Is the Expected Date of the Databricks IPO?

Databricks' has not provided guidance on the timing of their Initial Public Offering (IPO),but the company has been indicating its intention to go public for some time. Online sources suggest that the company looks to avoid this years turbulent market and is aiming for an IPO in 2023.

The pricing model of Databricks is based on usage and customers are charged based on the amount of data they process and the computing resources they use. It offers a collaborative platform that is designed to support teams working on data analytics projects, featuring tools for data engineering, data science, and machine learning, as well as features for collaboration and sharing. Databricks is an open-source technology, founded by the creators of Apache Spark and has continued to contribute to the Spark project and has also developed its own open-source technologies, such as Delta Lake and MLflow. It is intended for enterprise-level data analytics and includes features for managing data at scale, ensuring data security and compliance, and integrating with other enterprise systems.

When Will Stripe IPO? Stripe IPO – A Comprehensive Overview

Databricks’ Revenue and Financials

Although relatively little is known about Databricks' financials due to it being a privately held company, its main source of income is derived from customers subscribing to its Software-as-a-Service (SaaS) tools. Instead of charging a fixed rate for its services, the company utilizes 'Databricks Units' (DBUs) that measure processing capability per hour, then bills users for their usage on a per-second basis. TechCrunch reported that Databricks has an annual recurring revenue (ARR) of $600 million, having closed 2020 at $425 million ARR and experiencing a 75% year-on-year growth rate. With a fresh valuation of $38 billion, Databricks is now rumored to be worth 63 times its current ARR.

The Databricks IPO is a major milestone for the company and the big data analytics space as a whole. With its cloud-based platform and advanced analytics tools, Data Bricks has become a popular choice for businesses looking to leverage the power of big data. The IPO is likely to have a significant impact on the broader market, driving innovation and investment in the space. As businesses continue to generate more data than ever before, the future of big data analytics looks bright, and Data Bricks is well positioned to play a key role in shaping that future.

Baraka is regulated by the DFSA

Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.