ETF

ETFs have rapidly grown in popularity since being introduced to the stock market in the early 1990s. They tend to offer diversification, low risk, low fees and strong long-term returns, and allow investors to target specific countries, regions, sectors and assets. ETFs and Index Funds are a great place to start for beginners since they provide a well-diversified portfolio with low minimum investment requirements and fees.

What is an ETF?

An ETF – an Exchange Traded Fund – is an investment fund comprising a collection of assets that tracks an underlying asset or index. An ETF can hold a wide variety of different types of investments, ranging from stocks, bonds, commodities, and can be comprised of various indices, a collection of stocks based around a theme, and more, giving investors exposure to a wide variety of different assets with just one single investment. Some ETFs are even grouped by risk level and dividend distributions.

Listed and traded on stock exchanges, most ETFs can be bought and sold throughout the day, just like stock. Because of this its share price often fluctuates throughout the day just like a single stock.

Why is it important to have diversified investments?

Since ETFs offer an investor the opportunity to invest in several underlying investments in one asset, that means they offer investors great way to diversify their portfolios.

Diversification helps investors reduce risks and maximize returns by allocating investments among various assets that would each react differently to the same event. This is also helpful in reaching long-term financial goals while greatly minimizing risk.

What are some popular ETFs?

Some of the most well-known ETFs based on indexes include the SPDR S&P 500 ETF (SPY), which tracks the performance of the S&P 500 Index, and the PowerShares QQQ ETF (QQQ), which tracks the performance of the NASDAQ.[3] Popular ETFs based on commodities include the SPDR Gold Shares ETF (GLD), which tracks the performance of gold, and the iShares S&P GSCI Commodity-Indexed Trust (GSG), which tracks the performance of commodities with a heavy focus on energy resources.

What are the components of an ETF?

Dependent on the type of ETF, its components include the securities of the index that it is tracking, such as stocks, bonds and commodities. For example, the components of XLV – Health Care Select Sector SPDR Fund which tracks the performance of the healthcare sector – includes stock holdings from companies within the health care sector.

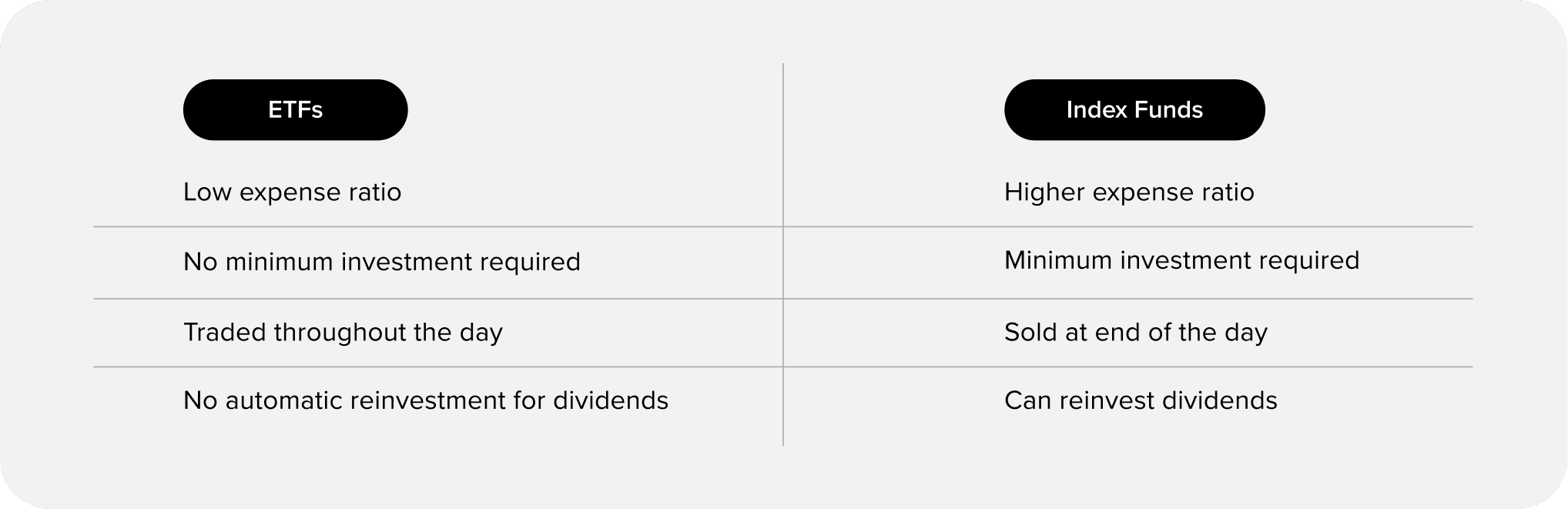

What are the differences between ETFs and index funds?

Similar to ETFs, an Index Fund is a collection of assets that tracks an underlying index. Index funds offer investors a good way to get exposure to multiple underlying indices in one financial instrument.

If an investor wanted to get exposure to the broad US market, they could buy Index Funds that track entire U.S. markets such as the Vanguard Total Stock Market Index (VTSMX), the Schwab Total Stock Market Index (SWTSX) or the iShares Russell 3000 Index Fund (IWV).

One of the differences between ETFs and Index Funds is that ETFs can be traded throughout the day, like stocks, whereas index funds can be bought and sold only at the end of each trading day.

This usually isn’t a concern for long-term investors since the timing of the trade during the day will likely have little impact on an investment in the long term.

Other differences between ETFs and Index Funds include the minimum investment required and dividend reinvestment opportunities.

Is there a minimum investment required?

ETFs usually have lower minimum investment than index funds and mutual funds. In many cases, to invest in an ETF, the requirement is to buy a single share. Some brokers, including Baraka, may offer fractional shares – the opportunity to invest in an ETF with just a fraction of the share cost.

How do ETFs track the market?

ETFs were created to offer an investment tool that tracks a specific market, sector or index. So, it’s important that an ETF replicates its underlying index. To do so, the provider of an ETF purchases all or a selection of relevant securities from within the index and weights them to best track the index. As the value of these holdings fluctuate, they track the index’s performance. This is called an ETF’s tracking difference or standard deviation, which is a measure of how well the ETF tracks its benchmark.

What type of returns can I expect with ETFs?

ETFs give investors countless options of easy-to-trade investment strategies that are great for long-term investing and growth.

Since ETFs do not seek to outperform the index, over the long-term ETFs typically produce better returns than actively managed portfolios, especially after taking fees into account.

For example, the S&P 500 ETF, known as SPY has returned 61.13% over the last five years for an annual return of 10.61%. That means that if you would have invested $100 in August 1, 2015, the value of that investment would be $161.13 as of July 25, 2020.

What are the fees for investing in ETFs?

Both ETF’s and Index Funds charge low fees to investors – called Expense Ratios – making it easy for anyone to invest in them. This is because the funds are passively managed by following a fixed formula on the index. Some examples of expense ratios on ETFs are .40% for the SPDR Gold Trust (GLD) and .68% for iShares MSCI Emerging Markets ETF (EEM) as of this writing.

In comparison, Mutual Funds are actively managed by active investors, and therefore charge higher fees – ranging from 1-2% on average – of the investor’s active balance.

How do I choose an ETF to invest in?

There are thousands of different ETFs to choose from. ETFs saw rapid growth after being introduced to the market in the early 1990s, and in 2019 alone, there were 2096 ETFs in the United States and 6,970 ETFs globally. With so many ETFs available, it might be difficult to choose which ones to invest in. To start, below are a few important metrics to look into before making an investment choice.

Expense Ratio: The ETF expense ratio is the annual fee that the ETF will charge the investor.

Holding Allocation: The holding allocation of an ETF is the percentage of weight the ETF has in each asset within the ETFs group of assets. There are several different ways ETFs structure holding allocations, such as equal weighted funds and weighting systems based on revenue, earnings or dividends.

Annual Dividend Yield: An ETFs annual dividend yield is how many dividends the ETF will distribute and how the dividends will be distributed. Dividends are usually distributed either as cash paid directly to investors or reinvestments in to the ETFs underlying investments.

Tracking Difference or Standard Deviation: Since ETFs look to replicate an underlying index’s performance, it’s important to understand how well the ETF tracks the underlying index. This can be a good measure of the returns an investor can expect to see based on the underlying index.