Have you ever made a purchase that receives a lot of criticism from your friends? Well, Adobe (ADBE) can relate; unfortunately for them, their friends are investors. In their latest string of pricey acquisitions, the company splurged a little more than expected, leaving investors with a sour taste in their mouths.

Last week, Adobe announced its largest acquisition ever: buying venture hot¹ Figma, a startup that allows digital creators to collaborate, for $20B. The company intends to close the deal in 2023, and will use a mix of cash and stock to fund the transaction.² News of the announcement sent its shares plummeting, as investors and analysts raised concerns about the health of the business.

While Adobe describes its latest move as accelerating its growth, many are left wondering why it was willing to pay 50 times Figma’s expected annual recurring revenue for 2022 and twice its valuation.

What happened

Shares of Adobe (ADBE) fell 17% on Thursday after the software giant released its fiscal Q3 results, falling short of investors expectations along with a little surprise merger agreement.³ The drop is the stock's biggest plunge since 2010.⁴ Following the news, analysts lowered price targets for ADBE, and investors saw further reason to be pessimistic about its future as shares fell to a new 52-week low of $292.14 on September 16.⁵

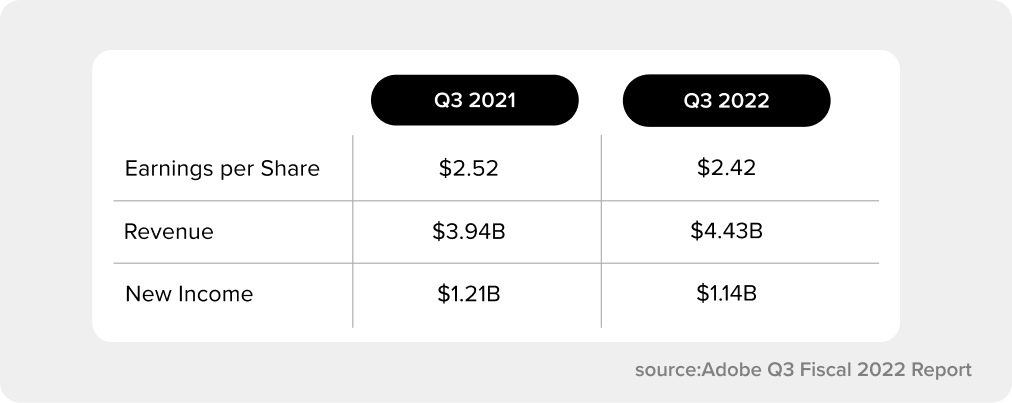

Even more, its earnings highlighted another quarter of decelerating growth, with revenue up 13% YoY in comparison to 22% from the previous year. The company issued mixed guidance for its fiscal Q4 2022, with revenue reaching $4.5B compared with analysts estimates of $4.6B.²

Despite its size and reach, Adobe – the biggest competitor in the design software market by sales – hasn't been able to attract the same level of interest from designers as rivals and its earnings are starting to feel the effects. Often associated with software such as Photoshop, Illustrator and Acrobat, the Adobe brand is said to constantly enhance its products and bring on new collaborations as the company grows. However, consumers still feel their recent product updates lack collaborative features, especially with the rise of remote working.

For those of you who haven’t heard of the design tool, Figma has gained a loyal following among software developers, product managers and other tech-savvy folks (including us). Figma’s products allow designers and engineers to share design iterations, as well as provide feedback and suggestions. Acquiring the company will enable Adobe to combat the increased competition, plus tap into the hot demand for collaborative editing tools, which has risen due to the increase in remote work caused by the pandemic⁴.

If the deal goes through, many well-known venture capitalists, including Sequoia Capital, Kleiner Perkins and Andreessen Horowitz, are looking to profit from the merger. This would be one of the largest buyouts of a venture-capital-backed startup in US history⁶. Adobe is paying a hefty price for Figma, with half of the purchase price coming in the form of cash and half in stock. Figma was valued at $10 billion in its most recent funding round and is expected to outperform annual recurring revenue of $400 million for 2022—approx one-50th of its sale price.⁷

Investors believe that Adobe is willing to pay an exorbitant amount, driven by desperation and not opportunity, with many speculating the sudden move comes from Figma and online rival Canva making moves for its own design tools. Though the company’s president of digital-media business, David Wadhwani disagrees with this assertion, saying Figma’s consumers are a new segment of users consisting developers and product managers vs Adobe's demographic of designers⁶.

Overall, despite Adobe’s current situation, investors should not only be focused on recent initiatives used to enhance the company’s current and future offerings. The deal with Figma has not been finalized despite its public announcement. Investors should conduct their own research to weigh the pros and cons of the deal before investment.

1https://www.figma.com/blog/figmas-series-e/

2https://news.adobe.com/news/news-details/2022/Adobe-to-Acquire-Figma/default.aspx

3https://www.barrons.com/livecoverage/stock-market-today-091522/card/rail-stocks-disney-danaher-and-more-stock-market-movers-MYueHbO6Pm8Vc4jr9F3c?mod=hp_LEAD_2_B_1

4https://www.cnbc.com/2022/09/15/adobe-to-acquire-design-platform-figma-for-20-billion.html

5https://www.tipranks.com/news/article/heres-why-analysts-are-unhappy-about-adobes-nasdaqadbe-figma-deal

6https://www.wsj.com/articles/adobes-push-at-next-reinvention-with-figma-deal-triggers-sticker-price-shock-11663509601

7https://www.cnbc.com/2022/09/15/adobe-to-acquire-design-platform-figma-for-20-billion.html

Baraka is regulated by the DFSA

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.