As a way of staying true to our mission of providing everyone access to the market, we offer assets that align with your personal beliefs. That’s right; if you didn’t already know, baraka makes it possible for you to invest in sharia-screened assets ranging from stocks to ETFs, to save you the trouble of trying to decide if a particular asset is halal or not.

Today, we break down sharia screening, which sharia-compliant assets we offer, and which market players are making moves.

List of 6 Halal Exchange-Traded Fund (ETFs)

- Wahed FTSE USA Sharia ETF (HLAL)

- S&P 500 Sharia Industry Exclusions ETF (SPUS)

- SP Funds S&P Global REIT Sharia ETF (SPRE)

- Wahed Dow Jones Islamic World ETF (UMMA)

- ETFB Green SRI REITs ETF (RITA)

- SP Funds Dow Jones Global Sukuk ETF (SPSK)

What is a Halal ETF? (Exchange-Traded Fund)

Halal ETFs are like regular ETFs—they're investment funds made up of a portfolio of assets that track an underlying asset. The difference is that halal ETFs comply with Islamic principles. In most cases, they track an Islamic benchmark index, which is composed of companies that should not be involved in any activities prohibited by Islam, such as interest-based lending (riba), gambling (maisir), and ambiguity (gharar).

Finally, halal ETFs are managed by an appointed committee, which regularly reviews the ETF to ensure strict adherence to Islamic principles.

Also read: 5 Trending Halal Stocks in 2023

6 Hot IPOs to Watch Out for in 2023

Pros of Exchange-Traded Funds

Pros:

- Diversification: A single ETF gives you exposure to several equities, an index, or industries.

- Trades like a stock: While you can buy several kinds of securities with ETFs, you can trade them just like stocks. For example, you can sell ETFs short, buy them on margin, or even trade futures and options.

- Lower Fees: ETFs generally charge lower management fees than other types of managed funds. ETF fees are called Expense Ratios that take into consideration all of the different expenses associated with managing any listing of an ETF. Fees typically range from as low as 0.5-1% per annum.

Cons:

- Lower Dividend Yields: There are ETFs that pay dividends, but their yields might not be as high as those of owning a stock or group of equities with a high yield.

- Potential High Costs: The actual commission paid to the broker might be the same, but there is no management fee for a stock

- Intraday Pricing: Long-term investors may not profit from intraday price swings because they may have a time horizon of 10 to 15 years. Due to these lagging changes in hourly prices, some investors may engage in additional trading. A large swing over a few hours might lead to a trade where the closing price prevents unreasonable worries from distorting an investing goal.

List of 6 Sharia-Certified Exchange-Traded Fund (ETFs)

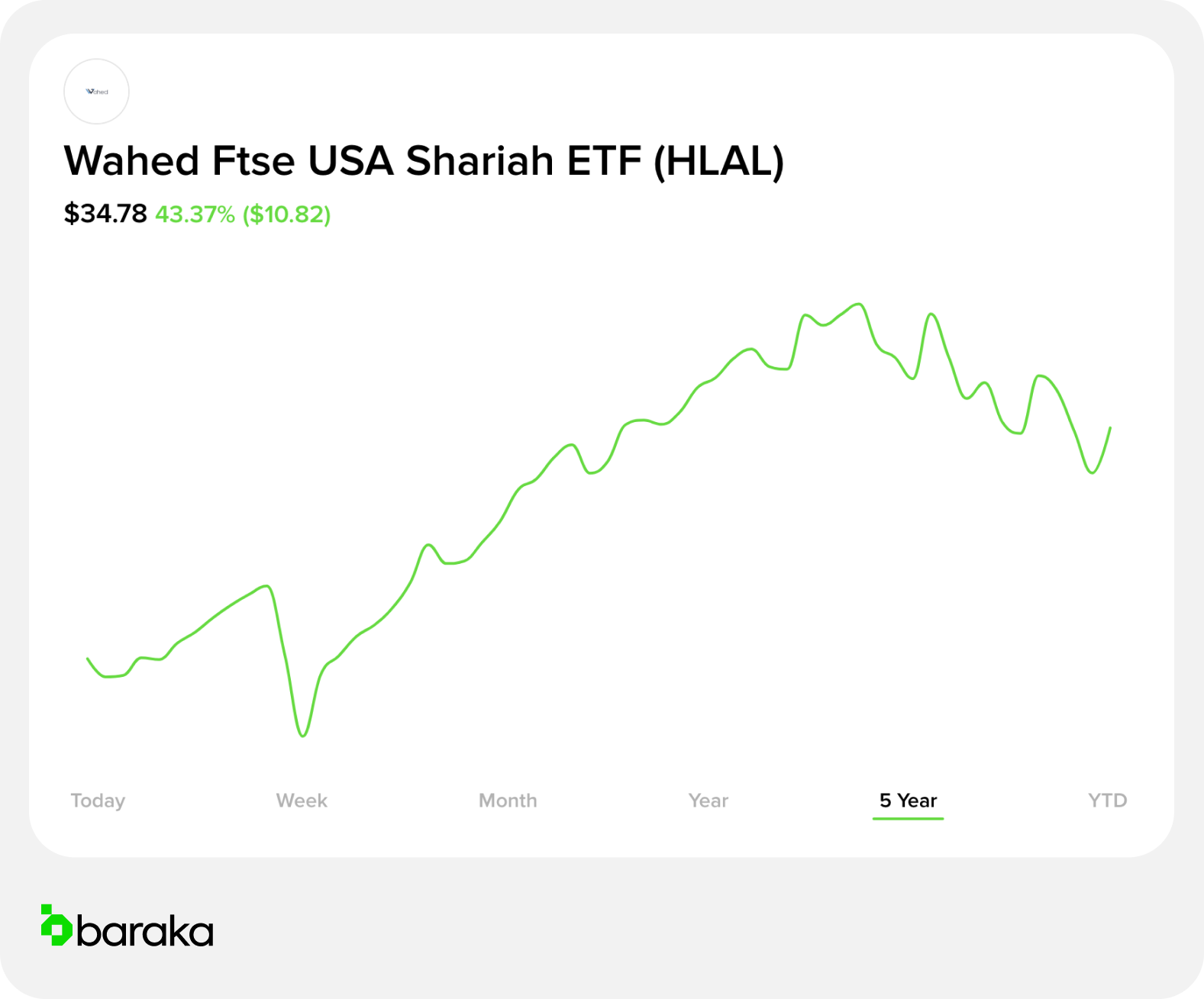

1. Wahed FTSE USA Sharia ETF (HLAL)

HLAL is a US-listed global halal ETF. The fund invests in large-cap and mid-cap stocks from the FTSE Global Equity Index Series that comply with Islamic law.

- Inception Date: July 16, 2019

- Assets under Management: $344.57 million

- Management Expense Ratio: 0.50%

- Listed on: NASDAQ

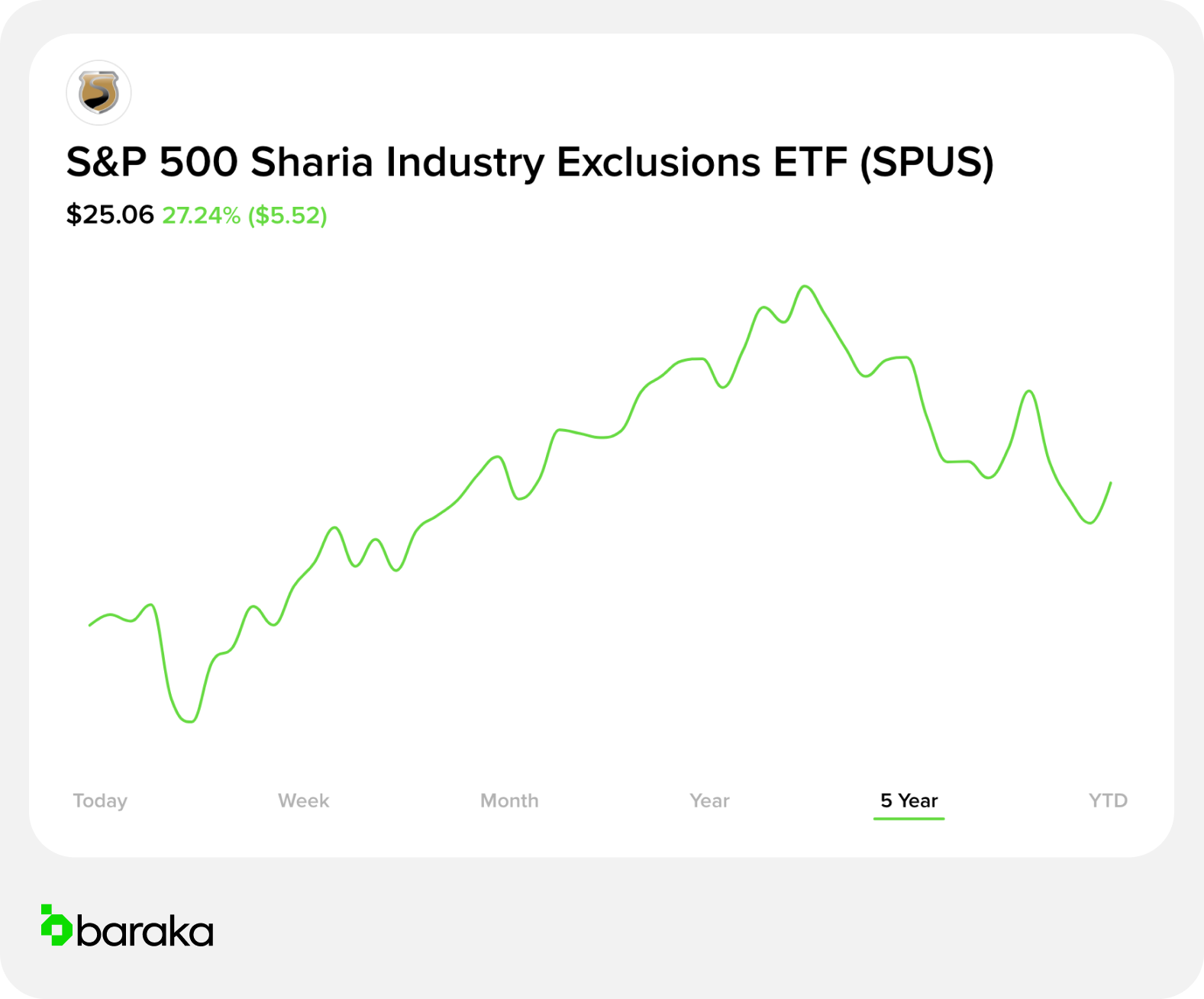

2. S&P 500 Sharia Industry Exclusions ETF (SPUS)

The fund seeks to track the performance of the S&P 500 Sharia Industry Exclusions Index.

- Inception Date: December 18, 2019

- Assets under Management: $371.33M

- Management Expense Ratio: 0.45%

- Listed on: NSYE

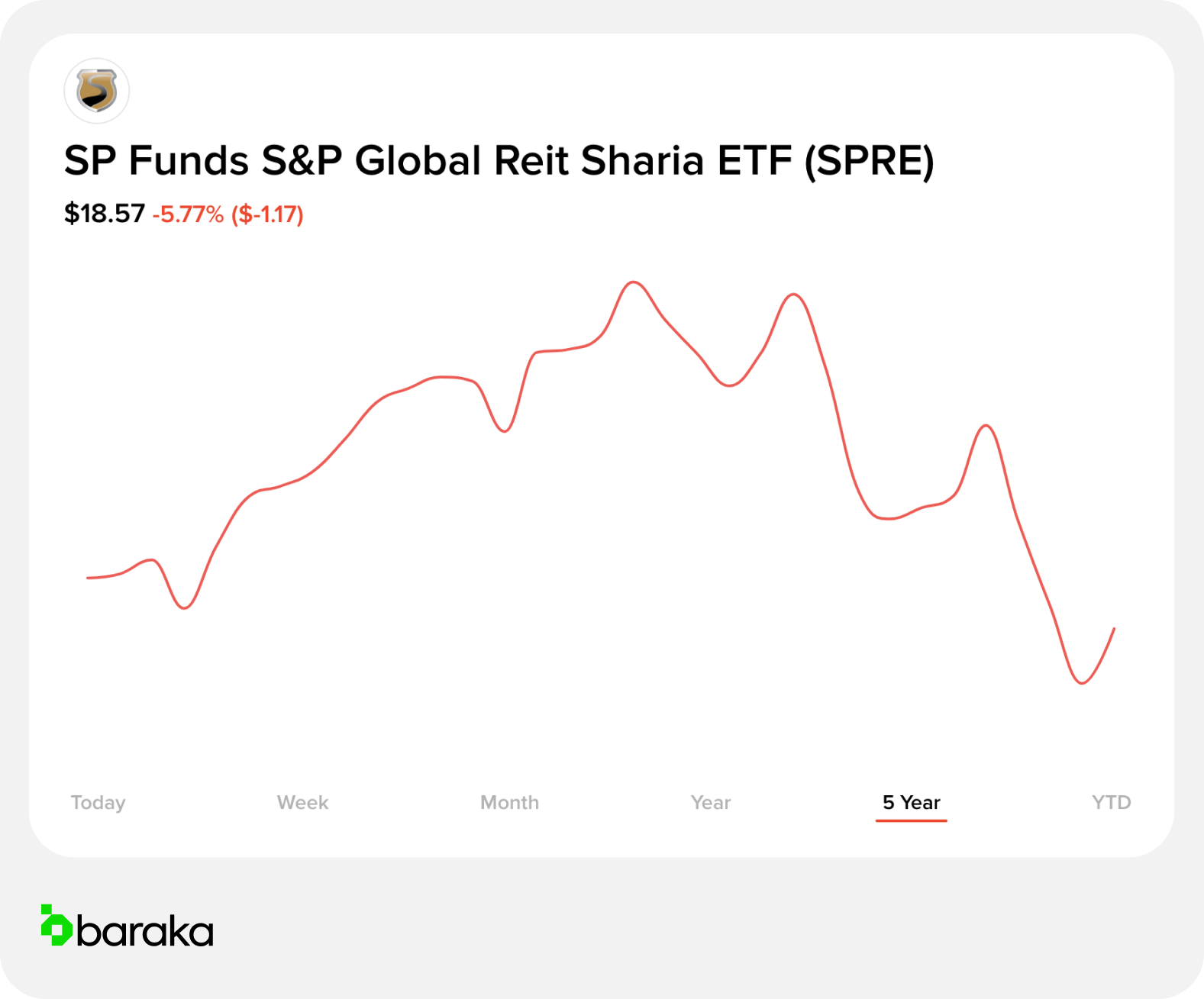

3. SP Funds S&P Global REIT Sharia ETF (SPRE)

The SP Funds S&P Global REIT Sharia ETF (SPRE) allows investors to gain exposure to real estate assets in a Sharia-compliant way by investing in REITs that meet certain screen criteria, including acceptable levels of debt, permissible income, and cash levels.

- Inception Date: December 29, 2020

- Assets under Management: $82.72M

- Management Expense Ratio: 0.55%

- Listed on: New York Stock Exchange

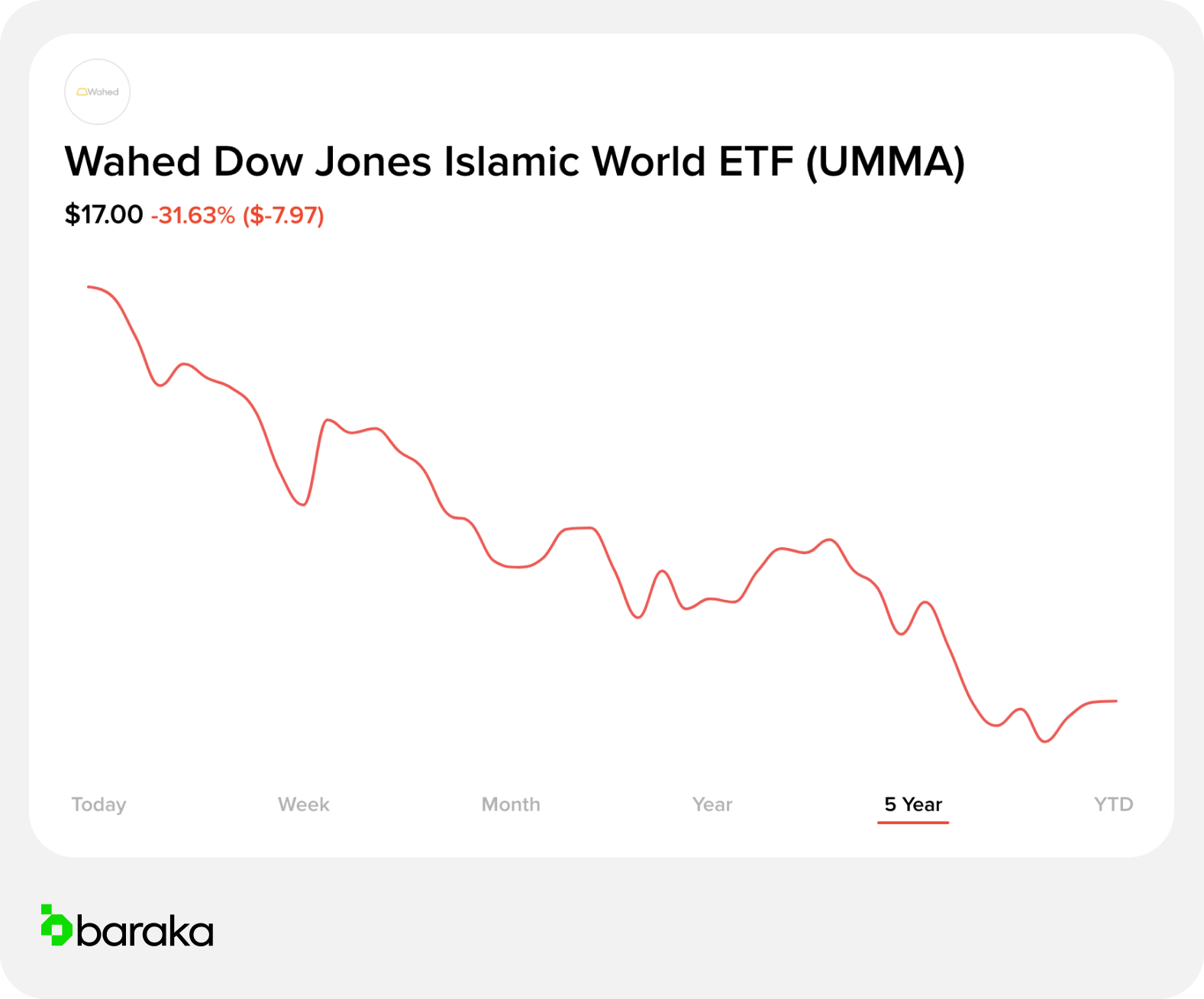

4. Wahed Dow Jones Islamic World ETF (UMMA)

UMMA, is the first Sharia-compliant and ESG-aware ETF available on Nasdaq. The ETF largely tracks the Dow Jones Islamic Market International Titans 100 Index and seeks to provide investors with exposure to global equities across developed and emerging markets.

- Inception Date: January 7, 2022

- Assets under Management: $58.12M

- Management Expense Ratio: 0.65%

- Listed on: NASDAQ

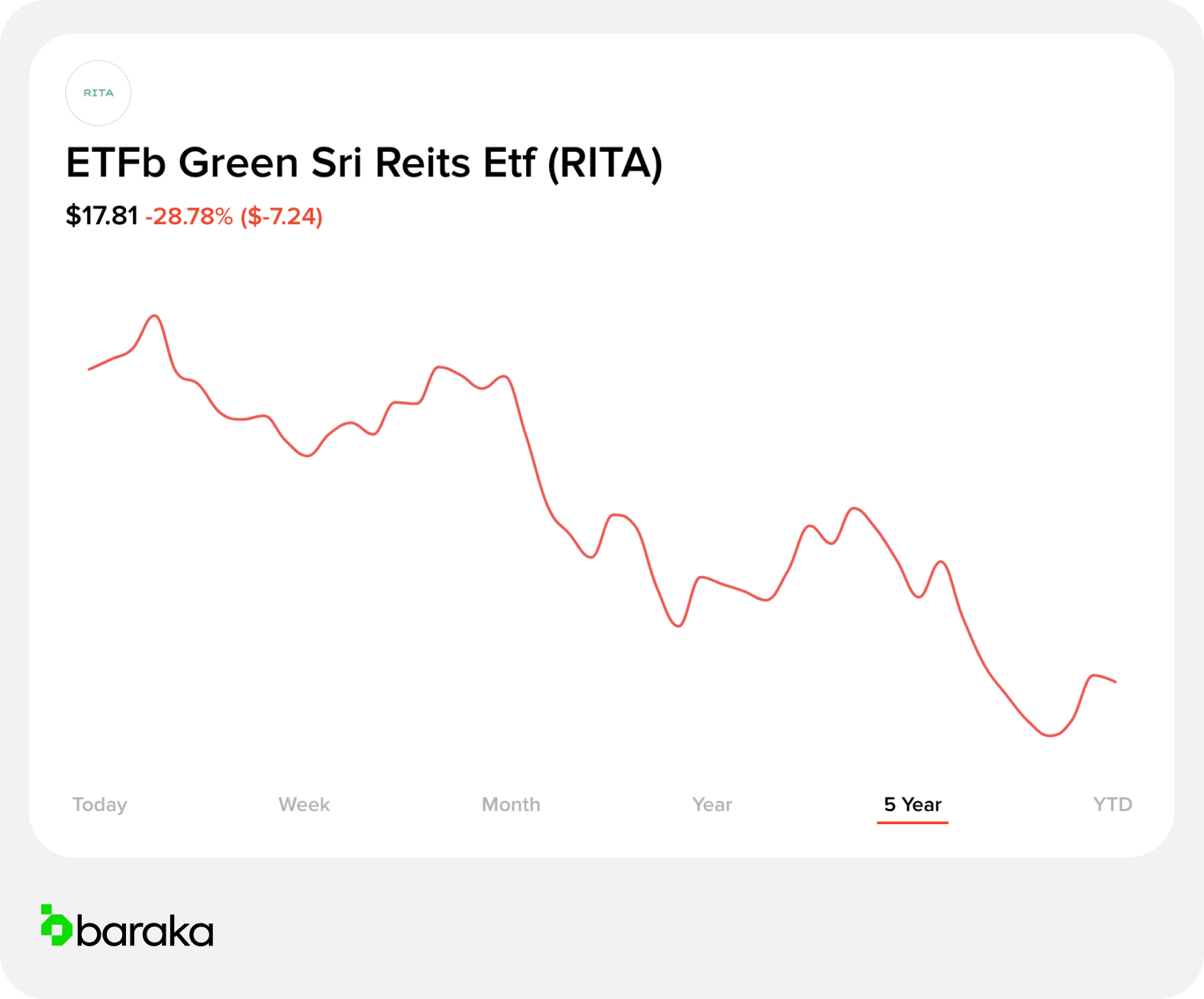

5. ETFB Green SRI REITs ETF (RITA)

The fund seeks to track the performance of the FTSE EPRA Nareit Ideal Ratings Developed REITs Islamic Green Capped Index. The fund uses a passive management approach to track the performance of the index.

- Inception Date: August 12, 2021

- Assets under Management: $7.33M

- Management Expense Ratio: 0.50%

- Listed on: NYSE

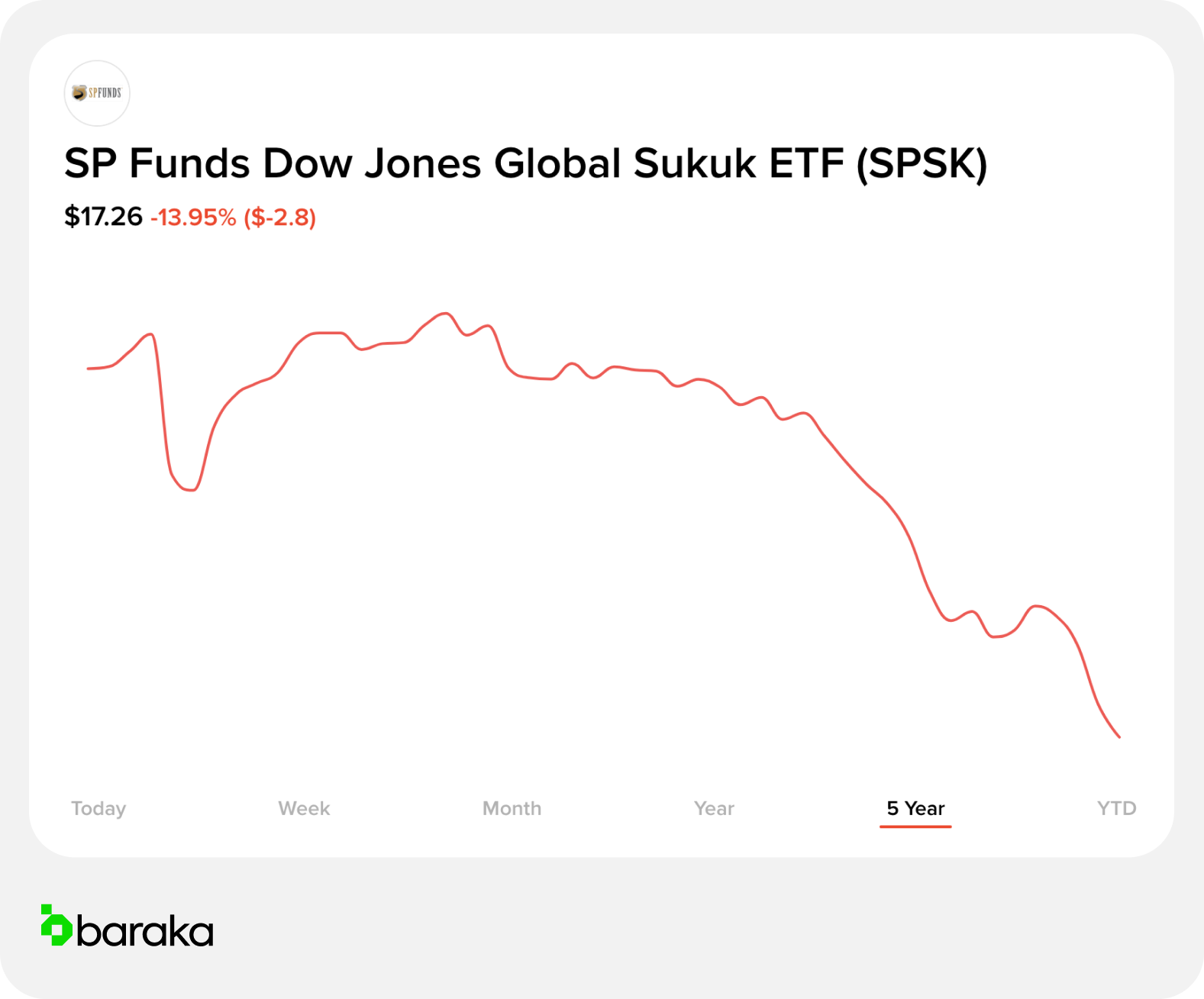

6. SP Funds Dow Jones Global Sukuk ETF (SPSK)

The investment seeks to track the performance of the Dow Jones Sukuk Total Return (exReinvestment) Index.

- Inception Date: December 30, 2019

- Assets under Management: $156.45M

- Management Expense Ratio: 0.55%

- Listed on: NYSE

How to Buy Halal – Sharia ETFs

At baraka, we offer users the chance to Halal-ify their portfolio through our Sharia Screener, allowing them to invest in stocks and ETFs without compromising their personal beliefs, instead of having to manually assess whether a particular ETF is halal or not.

Baraka is regulated by the DFSA

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.

Baraka provides access to traditional securities and does not intend to engage a Sharia advisor or obtain a fatwa regarding Sharia screened securities listed on the mobile app. Baraka does not have an Islamic Window endorsement from the DFSA. Clients should be aware that Sharia screened stocks may involve additional risks and costs. There can be no assurance as to the Sharia compliance of the securities listed by Baraka Financial Limited. Clients are reminded that views on Sharia compliance may also differ. If you do not understand such risks or costs or are unsure whether the securities offered by Baraka Financial Limited are in compliance with the principles of Sharia, you should consult a Sharia advisor.