P/E ratios – it’s that one thing that you’ve heard about a million times but have no idea what it means. Don’t worry – that’s what we’re here for. Understanding what a P/E ratio is simple once you understand where it comes from, how it’s calculated, and how to use it to analyze companies.

A P/E ratio (AKA price to earnings ratio) refers to the valuation of a company based on its current share price relative to its earnings per share. Investors use this calculation to compare the value of companies shares in an ‘apples to apples’ comparison.

Why is the P/E ratio helpful?

Looking at a company’s P/E ratio can be helpful in many ways.

- Since the P/E ratio puts companies on an even playing field by removing the effect of how many shares a company has outstanding, investors are able to analyze if a company’s share price accurately represents its projected earnings per share and if it’s a good value compared to other companies in the same industry.

- It’s also a widely used ratio by analysts to determine a company’s stock price.

- A company’s P/E ratio can tell you how investors view the company’s profitability – will it grow, stay the same or decline?

How to calculate the P/E ratio?

P/E ratio is calculated using a straight forward formula: simply divide a company’s share price by its earnings per share. A company’s share price can be found using the company’s ticker symbol and any finance website.

A company’s earnings per share is the amount of profit the company has for each outstanding share. Investors use earnings per share to analyze the health of a company. This is calculated by dividing a company's profit by its outstanding shares.

How to analyze a P/E ratio?

A P/E ratio can be used to measure various metrics and various conclusions can be made including if a company is undervalued, overvalued, if investors aren’t confident in a stock, if they are overly confident and more.

While these are all conclusions that can be made, they are not necessarily the right ones. To start, you shouldn’t try comparing two companies that operate in different sectors or industries.

It’s a much better strategy to use industry peers to analyze a company’s P/E ratio. For example, companies listed on the S&P 500 historically have a P/E ratio between 13 and 15. But companies listed on the Nasdaq, which tends to reflect the broader tech industry, are typically higher to reflect elevated growth rates.

Also read: What is modern portfolio theory?

If you are analyzing Visa’s P/E ratio, you wouldn’t want to compare it to AT&T since they are not in the same industry, so the comparison would be inaccurate. What would be more useful is if you compare Visa’s P/E ratio to Mastercard’s P/E ratio. At the time of writing this, Mastercard has a P/E ratio of 50.57, and compared to the overall financial transaction industry’s average P/E ratio of 27.46, it seems quite high. This is because investors have a lot of confidence in its future earnings. Investors are expecting continued profit growth, given the company’s economic moat and immense bargaining power. On the other hand, Visa’s P/E ratio is 41.93, which still seems high compared to the industry average but is lower than Mastercard.

Another way to analyze a company’s P/E ratio is to look at how high or low the number is. The higher a P/E ratio is, the more investors are willing to pay for profitability, and vice versa. For example, Tesla’s P/E ratio is 90.82, compared to the domestic automotive industry's P/E ratio of 27.21. This means that investors are willing to pay around $90 for every dollar of profitability.

As an investor, you can use the P/E ratio of a company to come to your own conclusions about a stock’s valuation. It’s always good practice to use more than one metric to make the best, educated decision on an investment

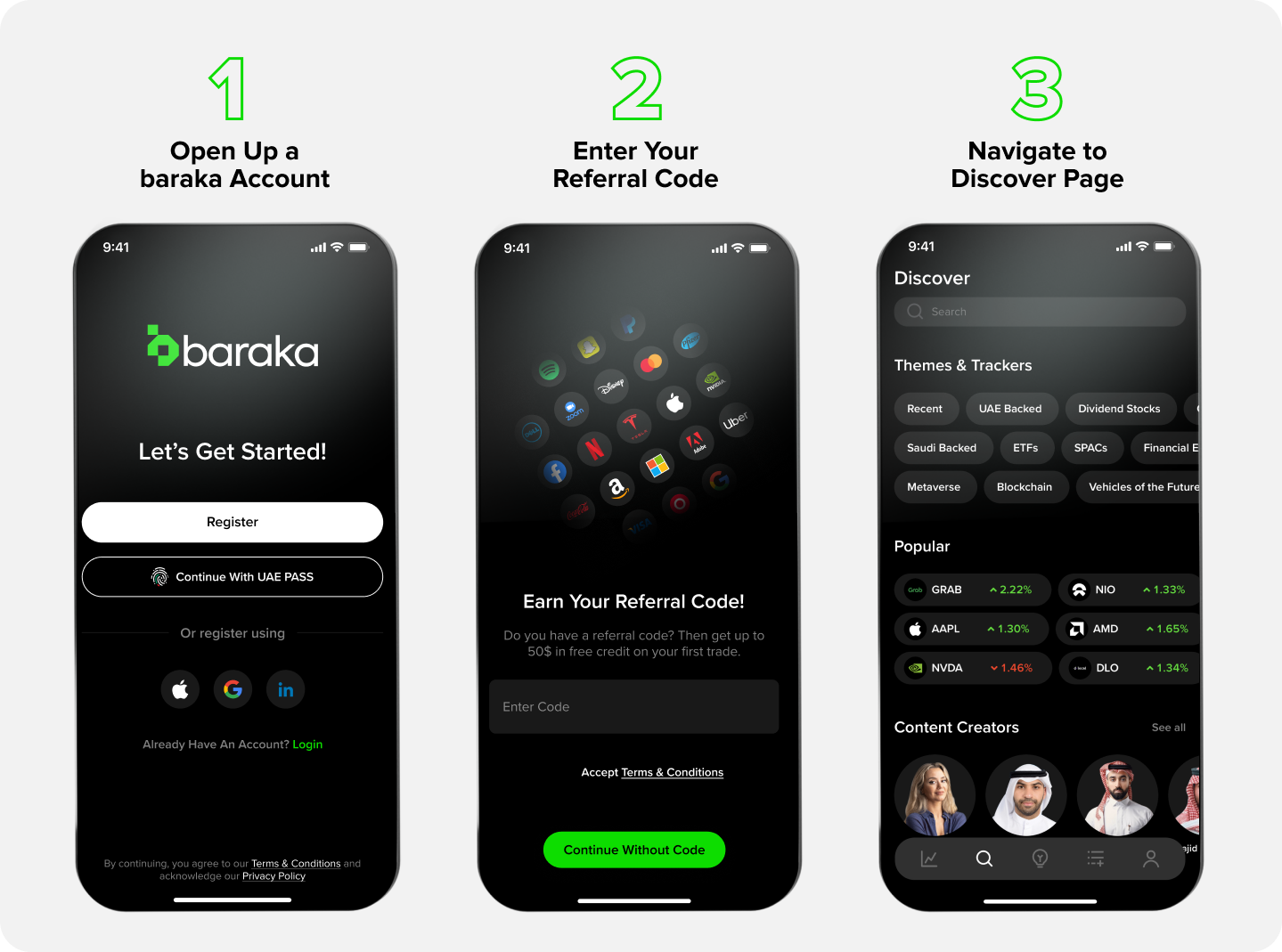

How to open your baraka account

Follow the below to set up your baraka account

- Download the baraka app from either the App Store or Play Store

- Open the app and sign up with your email address and phone number

- Complete your onboarding process by submitting a proof of identity document

- Fund your account with one of our many easy funding options

- Khalas, you are ready to trade