Overview

If you’ve ever visited a CFD provider’s website, you might have spotted a big, bold disclaimer about how likely investors are to lose money with them. It’s probably in a “prominent” place – like, say, grey text on a grey background. Yeah, that’s a red flag, alright. But hey, we won’t judge. Being tempted by the opportunity to access a seemingly limitless range of markets is understandable, because who doesn't like having options? However, the reality is that this never-ending selection may not necessarily result in a positive outcome, and this clever tactic serves as a great way to draw people in, and then switch them over to other financial products, such as CFDs – which might seem like a rewarding investment.

In our first blog, we explored the ins and outs of CFDs, discussing their nature and what it entails for investors. Today we will take a closer look at the hefty fees associated with CFDs and how CFD providers manage to finesse their way around them.

It is important to keep in mind that when engaging in CFD trading, you are responsible for the full amount of the transaction. Therefore, while it is impossible to predict market fluctuations, you should be aware of the fees associated with this type of investment.

CFD companies tend to profitThe spread ranges but is typic from their investors by charging a spread or commission fee. ally between 0.1% to 1% of the total value of the trade. In some cases, the CFD provider charges both a spread and a commission.

Spreads

CFD spread fees are fees charged when you open a contract for difference (CFD) position. The fees are built into the spread, which is the difference between the buy and sell prices of the underlying asset.

Let’s say the bid price of an asset was 125.6 and the offer price was 126.4. The difference between the two prices is 0.8, so that’s the spread.

Spread fees vary from broker to broker, and are composed of a few components:

The level of liquidity is determined by the volume of trades, the type of asset being traded, and the time of day. For example, if there is a lot of liquidity in the market, then the spread fee may be lower and vice versa.

When markets are volatile, the spread tends to be much greater allowing market makers to take advantage of the volatility and raise their spreads, while traders attempt to make money from the fluctuations.

When an asset's price is lower, its volatility is greater and its liquidity is lower, resulting in a wider spread. Conversely, when an asset is more expensive, its volatility and liquidity are both higher, causing the spread to be narrower.

Commission Fees

Many CFD brokers charge commissions for their services, which can erode profits over time. They may charge a flat rate for day trades and a variable or tiered commission for longer trades, including initial, daily financing, and closing fees. Commission fees can vary based on the CFD, trade size, and account type and can be higher for trading commodities or indices and lower for larger trades.

Overnight Funding and Inactivity Fees

You snooze, you lose! CFD overnight funding is a fee charged by brokers to traders for holding an open CFD position beyond the close of the trading day. This fee is designed to compensate the broker for the cost of borrowing the underlying asset and providing liquidity to the market. The overnight funding fee is usually calculated based on the size of the CFD position, the underlying asset’s interest rate, and the time of day. The fee is typically applied to all CFD positions held overnight, regardless of the size of the position, and is generally charged on a daily basis.

Inactivity fees are like a broker's version of a gym membership: you pay a fee whether or not you use it. This fee is imposed on traders who do not maintain an active trading account and is designed to encourage traders to remain active in their trading accounts. Inactivity fees are typically charged on a monthly or quarterly basis, and vary by broker. The amount of the inactivity fee will depend on the type of account, the broker’s policies, and the amount of time that has passed since the last trade was made.

Slippage

Slippage fees are like a ‘hidden tax’ on trading caused by the difference between the desired and actual execution price, often due to fast-moving markets. Brokers charge these fees to cover the gap, calculated as the difference between the desired price and the actual execution price multiplied by the number of contracts traded. For example, a slippage fee for 10 contracts of an asset would be the difference between desired and actual execution price multiplied by 10.

For example, if you wanted to buy 10 contracts of a CFD stock at a price of $50, but the actual price ended up being $49.50, then the slippage fee would be calculated as follows:

Slippage fee = 0.50 x 10 contracts x base currency exchange rate

In this example, if the base currency exchange rate was 1.25, then the total slippage fee would be $6.25.

Slippage fees can also be affected by the size of the trade and the spread between the bid and ask prices. If the size of the trade is large, the spread between the bid and ask prices are likely to be wider, resulting in a higher slippage fee.

Leverage

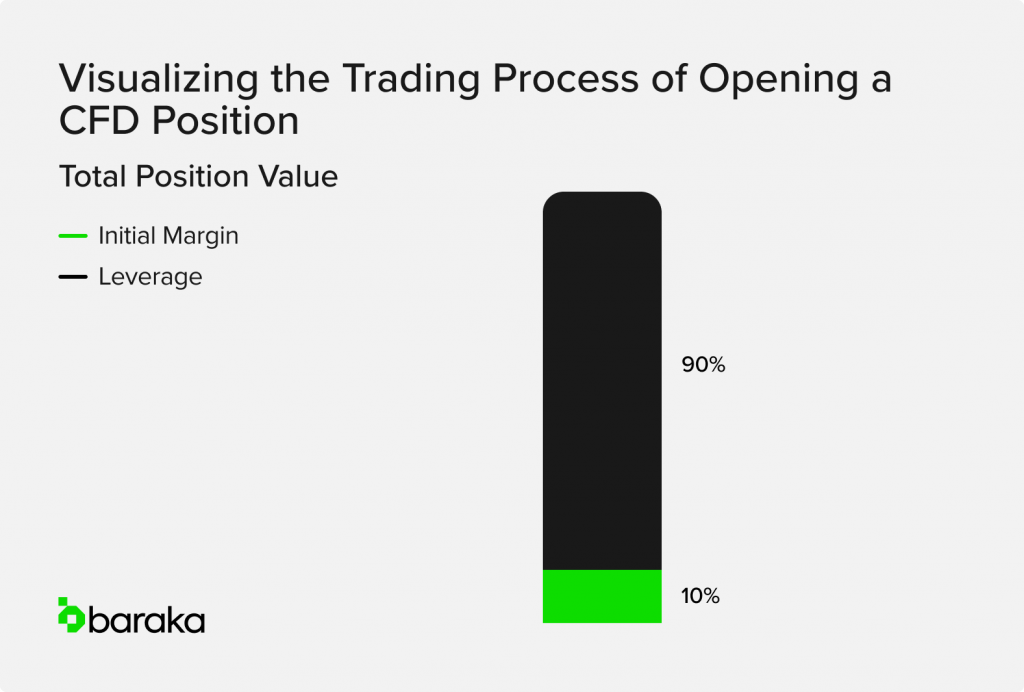

CFD leverage fees are calculated based on the size of the position and the amount of leverage that has been used to open the position. Typically, the higher the leverage used, the higher the leverage fees. This is because leverage amplifies the potential gains and losses of a position.

Let’s say you opened a CFD position with a leverage of 10:1. If you buy $100 worth of a CFD, you will be required to put down 10% of the actual value as a deposit. This is known as the margin. In this case, the margin would be $10. If the position moves in your favour, you will profit from the full $100, but if it moves against you, you will have to pay the full amount of the loss. The leverage fee is the fee charged by the broker for the use of the leverage, and it is usually a small percentage of the position size. So, in this example, if the leverage fee is 1%, the fee you will have to pay will be $1.

It is also important to note that leverage fees in CFD trading are based on position size and leverage used. Higher leverage leads to higher fees, amplifying potential gains and losses. A deposit (margin) is required, with a leverage fee charged by the broker. This fee is usually a small percentage of the position size and can still be charged even if the position results in a loss.

CFD trading often comes with hidden fees, so investors should be cautious and research carefully to avoid unexpected costs.

baraka is regulated by the DFSA

Your investment can go up and down and you may get back less than invested. Carefully consider each product’s investment objectives and risk factors before investing. The above should not be considered as 1:1 financial advice.