Overview

With the promise of high returns, Contracts for Difference (CFDs) have become increasingly popular in recent years, with ads popping up everywhere from Sheikh Zayed Road to billboards across the city, endorsed by well-known celebrities. These ‘investment’ platforms have positioned themselves like skyscrapers in front of inexperienced investors, who may not understand the risks associated with them. While CFDs may promise the world, they should be taken with a grain of salt, as they are not the same as stocks.

In this four-part blog series, we'll delve into the intricate, unpredictable world of CFDs. We'll trace its origins and unpack its complexities and dangers. By the end of it, investors should have a clear understanding of why these investments promise more than they're really worth.

Contracts for Difference, or CFDs, are a type of financial instrument that gives speculators the allure of making a profit from the movement of the price of an underlying asset. They are a paper contract between an investor and a company, with no underlying holding. It allows traders to speculate on the price of commodities, shares, bonds, indices, currencies, and cryptocurrencies by entering into a contract with another party to pay the difference between the opening and closing prices of the underlying asset.

CFD trading platforms emerged in the 1990s, and became popular with retail traders as the internet became more widespread. However, regulators have expressed concern about the high risk and high leverage of CFDs, leading to limitations on their advertising, distribution, and sale to retail traders in some countries by entities like the European Securities and Markets Authority, the UK Financial Conduct Authority, and the Australian Securities and Investments Commission. The FCA states that 80% of retail customers lose money when investing in CFDs. Brokerages that offer these derivatives must also take steps to protect their customers from ending up in debt when their trades fail, and the FCA has even banned cryptocurrency CFDs altogether.

Despite these regulatory challenges, CFD trading remains popular among retail traders and reputable CFD trading firms continue to operate globally.

CFD Trading Business Model

To get a better grasp on why CFD trading is seen as contentious, it's beneficial for investors to understand how CFD firms profit off their users. But first, let’s understand how a CFD trade actually works.

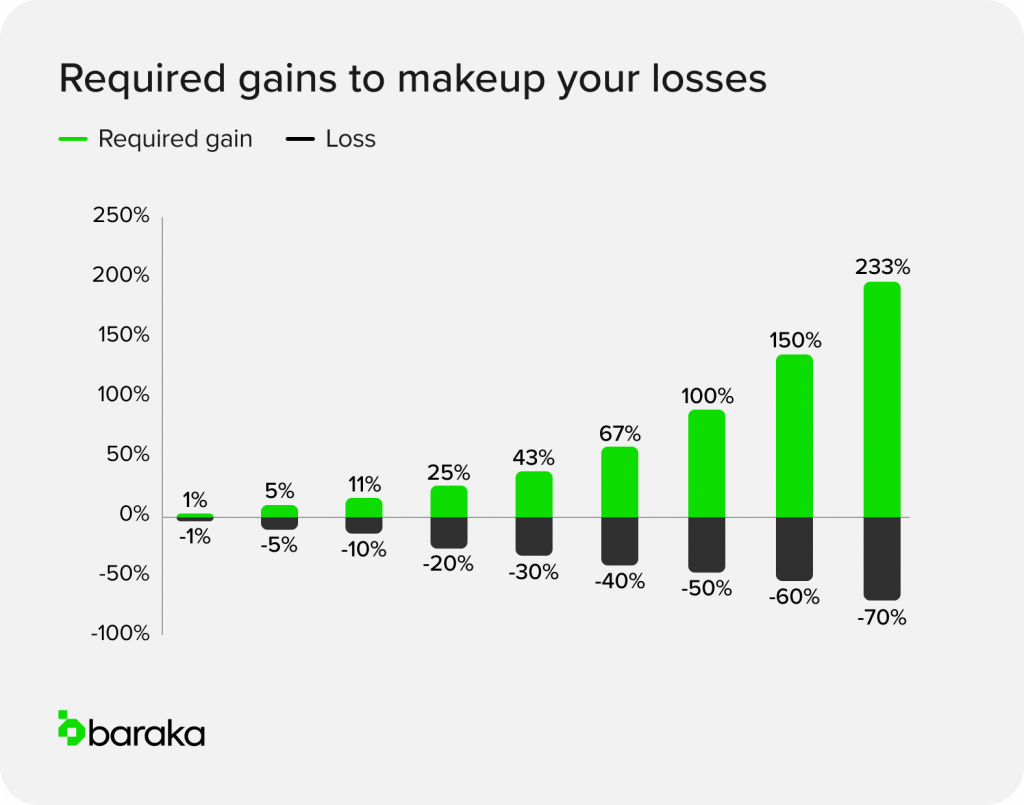

When you trade a CFD, you pay a margin requirement to open the trade and owe the broker the spread (difference between the opening and closing prices) plus fees upon closing the contract. Trading with CFDs can enable investors to trade with more money than they have deposited, in some cases 100 times more money than they have deposited. It sounds like you can get rich quick, right? Well, no, not really. It also means that potential losses can be much greater than their initial investment. The profit or loss is determined by the difference between the opening and closing prices of the CFD.

Now that you understand how CFDs work, let's see an example.

Example

You buy 50 contracts on a stock that is trading at $100 a share. The stock then drops $10 in value. Your exposure is (50 * 100) = $5,000, but because your 'margin' is only 5% of that, the initial amount you put up is a mere $250.

A breakdown:

Stock Trading

- Initial Investment – $250

- Value Drop – 10%

- Loss – $25

CFD Trading

- Initial Investment – $250

- Value Drop – 10%

- Loss – $500

The Bottom Line

We get it; CFDs may appear to be an appealing option to those who watch videos that promise quick riches, however, as you’ve seen, they may not always deliver on their promises. Most traders do not consider CFDs appropriate for long-term investment. Because CFDs incur high fees if held for long periods of time, traders usually consider them only as short-term trading instruments where they can increase leverage on their positions.

In our next blog, we will break down the fees associated with investing in CFDs.

baraka is regulated by the DFSA

Your investment can go up and down and you may get back less than invested. Carefully consider each product’s investment objectives and risk factors before investing. The above should not be considered as 1:1 financial advice.