If you were worried that meme stocks had died out, think again.

A pair of meme stocks—GameStop and Bed Bath & Beyond—saw their stock prices spike Tuesday, mirroring the considerable swings we saw last year.

The so-called meme stocks became a household name in January 2021 when retail investors on social media began urging others to purchase and hold shares of highly shorted firms1. Short sellers were targeting stocks, hoping to make a profit by repurchasing the stock later at a lower price, especially with companies they believed would suffer due to pandemic conditions. Despite the world returning to some normalcy, the meme stock saga continues2.

What's going on?

As with last year, there's no fundamental reason for the sudden surge in meme stocks; instead, traders on Reddit's WallStreetBets and other platforms are once again focusing their efforts on driving a short squeeze on the meme stocks that soared early last year.

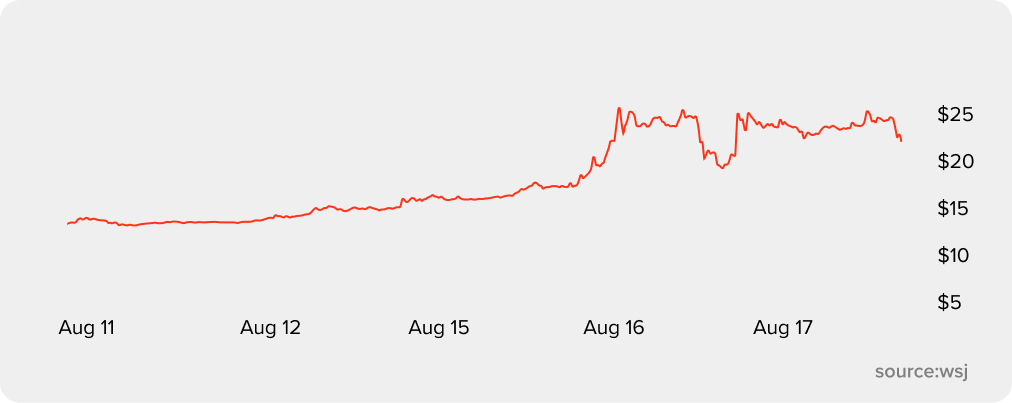

Bed Bath & Beyond has struggled financially in recent years, with persistent market share losses and plunging profitability. In Q1 2022, the company announced a loss of $224 million for its adjusted operating profits, with $107 million in cash at the end of the quarter3, making it a popular target for short-sellers. But the meme stock craze has brought Bed Bath & Beyond stock back to life, sending its shares up more than 300% so far in August4, with the stock up by nearly 70% in intraday trading on Tuesday5, after a massive short squeeze.

In addition, the video game retailer GameStop has also been making waves as its shares rose 12% Monday and have gained 30% in the last five days6. There are no fundamental developments to explain the recent rise in GameStop's stock, but the company has benefited from the rally thanks to favorable attention from Bed Bath & Beyond. In July, 22% of GameStop's float – basically all its available shares – were sold short, due to investors betting on the stock to fall7. On the other hand, Bed Bath & Beyond, which had a higher float of 103% was also sold short, had a greater number of investors expecting the stock to fall8. In general, meme stocks move in tandem with each other, therefore a victory in one tends to cause traders to be more aggressive with stocks.

But Why?

Although GameStop hasn't introduced any new developments, there is a connection between itself and Bed Bath and Beyond. The video game retailer's chairman, Ryan Cohen, who played a pivotal role in GameStop's unstoppable rise, is also an activist investor in Bed Bath & Beyond9. A regulatory filing on Monday revealed that Ryan Cohen's RC Ventures owns nearly 12% stake after buying 1.67 million call options on BBBY stock. Cohen's options consist of 1.12 million $60 strike calls and 44,400 $75 strike calls, all of which expire in January 202310. The options allow Cohen to bet that the stock will rise significantly before January, allowing him to purchase shares at a discount.

According to the recent filing, Cohen's position in Bed Bath & Beyond remains unchanged since he first revealed his stake earlier this year. The company itself has lowered its total shares outstanding, making Cohen's stake a higher percentage of the company. Following his announcement earlier this year, Bed Bath & Beyond agreed to add three board members of Cohen's choosing. The company also replaced its CEO Mark Triton in June, with independent director Sue Grove taking the reins on an interim basis11.

Overall, despite BBBY climbing six-folds in 15 trading sessions, investors should not only be focused on recent gains and should conduct their own research to weigh the pros and cons of Bed, Bath and Beyond stock before investment.

1https://www.forbes.com/sites/jonathanponciano/2021/02/10/meme-stock-saga-officially-over-gamestop-short-interest-plunged-70-amid-20-billion-loss/?sh=5bd32441b213

2https://www.wsj.com/livecoverage/stock-market-news-today-08-08-2022/card/meme-stocks-amc-bed-bath-beyond-soar-on-retail-investor-enthusiasm-VoGD7aSc11AnupJf5Qb6

3https://bedbathandbeyond.gcs-web.com/static-files/446b5112-75d4-4588-9127-136783bb82cc

4https://www.washingtonpost.com/business/2022/08/17/bed-bath-and-beyond-stock-price/

5https://www.forbes.com/sites/sergeiklebnikov/2022/08/16/bed-bath–beyond-jumps-30-as-meme-stock-traders-snap-up-shares-despite-analyst-warnings/?sh=5829b27d7436

6https://edition.cnn.com/2022/08/08/investing/meme-stocks-bed-bath-beyond-gamestop-amc/index.html

7https://www.fool.com/investing/2022/08/08/why-gamestop-stock-gaining-today/

8https://www.fool.com/investing/2022/08/15/why-bed-bath-beyond-stock-was-up-again-today/

9https://www.washingtonpost.com/business/2022/08/17/bed-bath-and-beyond-stock-price/

10https://investorplace.com/2022/08/ryan-cohen-just-gave-bed-bath-beyond-bbby-stock-a-huge-boost/

11https://www.cnbc.com/2022/08/17/bed-bath-beyond-surges-again-on-wednesday-continuing-august-meme-rally.html

Baraka is regulated by the DFSA. Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product's risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.