The digital age has brought on a new level of interconnectivity through which news travels faster than we can imagine. In turn, this drives fear to spread faster than an invisible virus. We've all been there—when others panic, we worry too, even if we don’t understand the full extent of what is happening.

This is even more prominent when it comes to the stock market. When people hear the word "recession," they immediately jump into action—they start worrying about their jobs, their investments, and they look for ways to secure their financial well-being. This is totally normal.

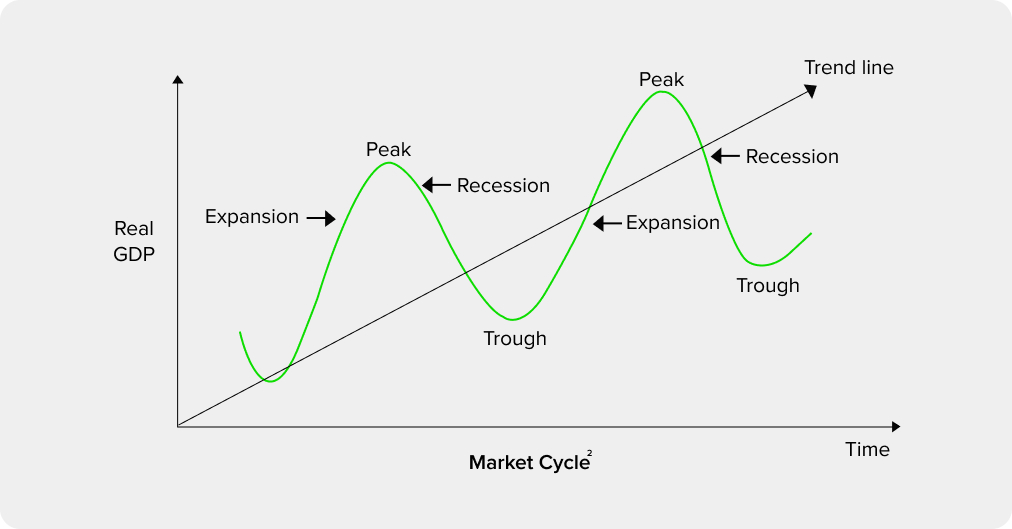

It's natural for us to react this way and to consider steering away from the stock market. When the economy is growing and businesses are making money, it's easier to invest in the market. Most stocks rise during economic expansions, but not all of them perform equally well when the economy contracts. However, you must keep in mind that markets are cyclical, and history tends to repeat itself. During pullbacks, the market tends to respond in a way that's relatively predictable. However, it is important to note that not all sectors perform badly. Those that have remained stable or performed well during previous recessions are likely to react similarly in the coming ones.

While we cannot be certain whether or not a recession is on the horizon, we will look at what a recession is and which sectors have historically proven to be recession-proof.

According to the National Bureau of Economic Research, a recession is defined as two consecutive quarters of negative gross domestic product (GDP)1. But what does that mean?

Markets are cyclical, so economic activity expands and contracts over time. When it expands, this means the country’s economy is doing well, i.e. it is growing and its economic output is increasing. However, economic activity can contract too, meaning that economic output is decreasing, which can potentially lead to a recession. Recessions are often marked by declining sales, lower profits, and general business failures.

Now that you understand what a recession is (at least we hope you do), let's deep dive into the sectors that claim to be recession-proof.

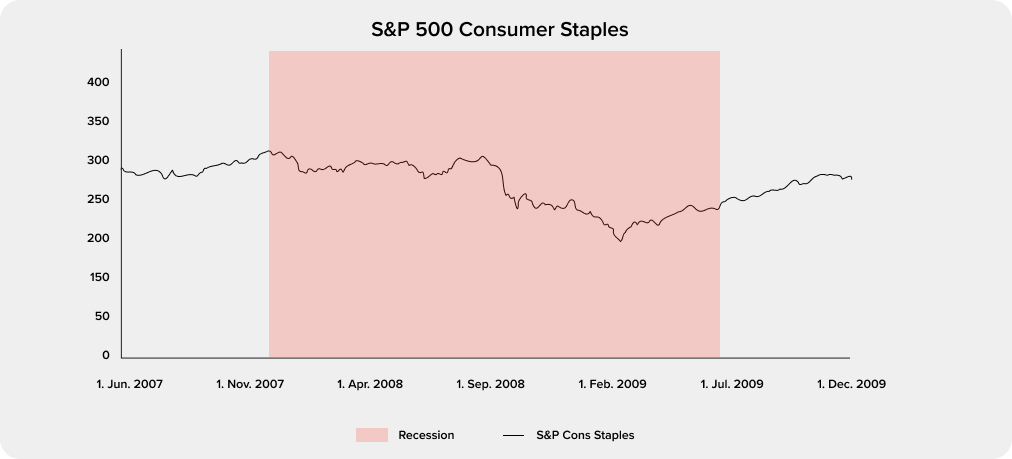

1. Consumer Staples

Regardless of any economic downturn, consumers will continue to purchase certain household goods and services on a recurring basis. These include daily essentials such as food and beverages, personal care, household and home care products such as paper goods, alcohol, tobacco, and cosmetics3. In the Great Recession, the consumer staples sector saw the least decline. It only fell 21.14% from the start of the recession, from 302.02 points to 238.18 points at recession close4. As you can see below, the price index chart below shows this sector's movement wasn’t so drastic in this period.

There are two main reasons why consumer staples stocks can hold their own during tough economic times. First, the products these companies make are essential to human survival and, therefore, tend to be purchased even in lean times. Second, these companies' goods are low-cost necessities that people will buy even if they have little money.

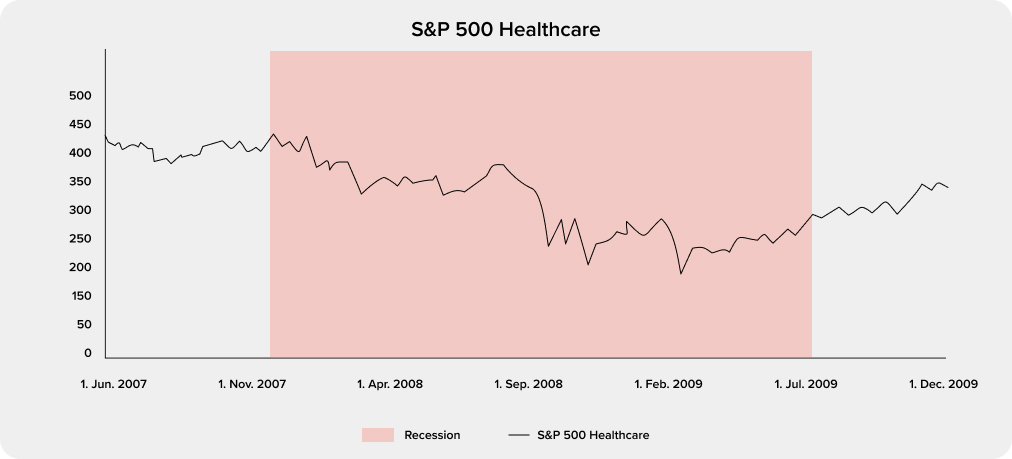

2. Healthcare

Everyone knows your health is your wealth. In good and bad economic times, healthcare services and products are always in demand—simply because healthcare is a necessity and many people are less likely to skimp on it even if their income declines.

The healthcare sector of the S&P 500 fell just 27.05% during the great recession, which was the second least affected industry during the time5/sup>.

When times are tough, people tend to cut back on expenses that seem unnecessary. But they will not stop seeing their doctors when they or other family members get unwell. This is why health care has not been affected much by the recession.

3. Utilities

Even during recessions, when many other businesses close and people lose their jobs, demand for electricity, water, waste collection, and natural gas remains relatively stable. Utility-like companies generate reasonably consistent earnings throughout recessions.

But that doesn't say that utilities don’t dip, just not as deep as the overall S&P 500. We can see how they performed in comparison to this index. In 2008, the S&P 500 plummeted by 37% for the entire year. Utilities, on the other hand, beat that by 8%, losing a total of 29%5. It was the third best-performing sector during that terrible year.

Although people may have less disposable income during periods of economic duress, they still need to heat their homes, take showers, and keep the lights on.

The Bottom Line

Frankly speaking, no industry is fully recession-proof. This is simply because no company can guarantee that it will generate investment gains during a period of economic contraction. In the past, the industries mentioned above have shown to perform well even when the economy is weak and consumer confidence is low but like we’ve said before, previous performance is not an indication of future results – the key to a strong portfolio is a well diversified portfolio.

Overall, despite the current situation, investors should not only be focused on recent gains, and should conduct their own research to weigh the pros and cons before making an investment.

1 https://www.nber.org/research/business-cycle-dating/business-cycle-dating-procedure-frequently-asked-questions

2 https://www.higherrockeducation.org/glossary-of-terms/Recession

3 https://www.fidelity.com/sector-investing/consumer-staples/overview

4 https://www.netcials.com/finance/if-recession-comes-which-sectors-will-be-hit-hardest-based-on-past/

5 https://37parallel.com/four-of-the-best-investments-in-a-recession/

baraka is regulated by the DFSA

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.