What is NYSE?

The NYSE, or New York Stock Exchange, is the biggest equities-based stock exchange in the world, based on its listed securities and market capitalization. The history of the NYSE dates back to 1792 when the exchange was first founded. Though it was first developed to be private, in 2006 it became a public entity, following the acquisition of Archipelago, which is an electronic trading exchange.

Definition, History and Facts for both Nasdaq and NYSE

So what is the NYSE and how does it work? The NYSE was founded in 1792, with many of some of the biggest and oldest US companies being listed. While this stock exchange has been around since 1792, it only became public in 2006 and is now owned by Intercontinental Exchange, as of 2013. When it began back in 1792, the exchange had a total of five securities, including two bank stocks and three government bonds. The longest listed stock is Consolidated Edison which joined in 1824.

Since its beginning, there have been a number of stock crashes that have shaped the way the market is even today! The NYSE opens Monday through to Friday from 9:30 a.m. to 4:00 p.m. Eastern time, making this the time where trades happen. Monitoring the stock market cycle during these times is important as this is when changes happen and investors are able to purchase stock.

Sitting behind the NYSE when it comes to market capitalization is the Nasdaq. This exchange is based on being a dealer's market, meaning that instead of trading directly with one another, all participants trade through a dealer. The NASDAQ trades electronically, unlike the NYSE which has a physical trading floor. These differences are why certain businesses choose to be on one or both of these kinds of exchanges. The NYSE and NASDAQ are two of the most popular exchanges as they hold the most market capitalization.

How Does NYSE Work?

Unlike the NASDAQ, the brokers trade on the floor of the NYSE, auctioning securities off for the highest prices. The NYSE works by providing a place for businesses to sell a certain amount of stock within their business, and investors look to buy this stock up. Interested investors will buy stocks within a business and this provides this company with the capital that it may need. In exchange, an investor may receive dividends and as the stock price rises within certain businesses, the investor may be able to sell stocks for more than they were purchased for, making a profit.

What is NASDAQ 100?

The NASDAQ 100 index is a list of the largest and most actively traded 100 companies on the NASDAQ stock exchange. This index does not include companies that are in the financial industry, though all other sectors are included. The NASDAQ 100 is extremely important as it plays a vital role in informing investors of top-performing companies, influencing trades and the economy as a whole!

How Does NASDAQ 100 Work?

This index works by weighting the top 100 companies on the NASDAQ, according to their market capitalization. Following these businesses from various industries, not including any from the financial sector, helps investors to determine the best investment options. Businesses will sell stock while investors purchase on the NASDAQ exchange, and these investments are monitored.

NASDAQ and NYSE Listing Process and Requirements

A business can be listed on either the Nasdaq or NYSE as long as they meet the listing requirements set out by each exchange. When a company is listed on both the Nasdaq and NYSE, it is referred to as a dual listing. The listing requirements differ for each of these exchanges and before listing, a business would have to look into the different processes and requirements that are set out by each one.

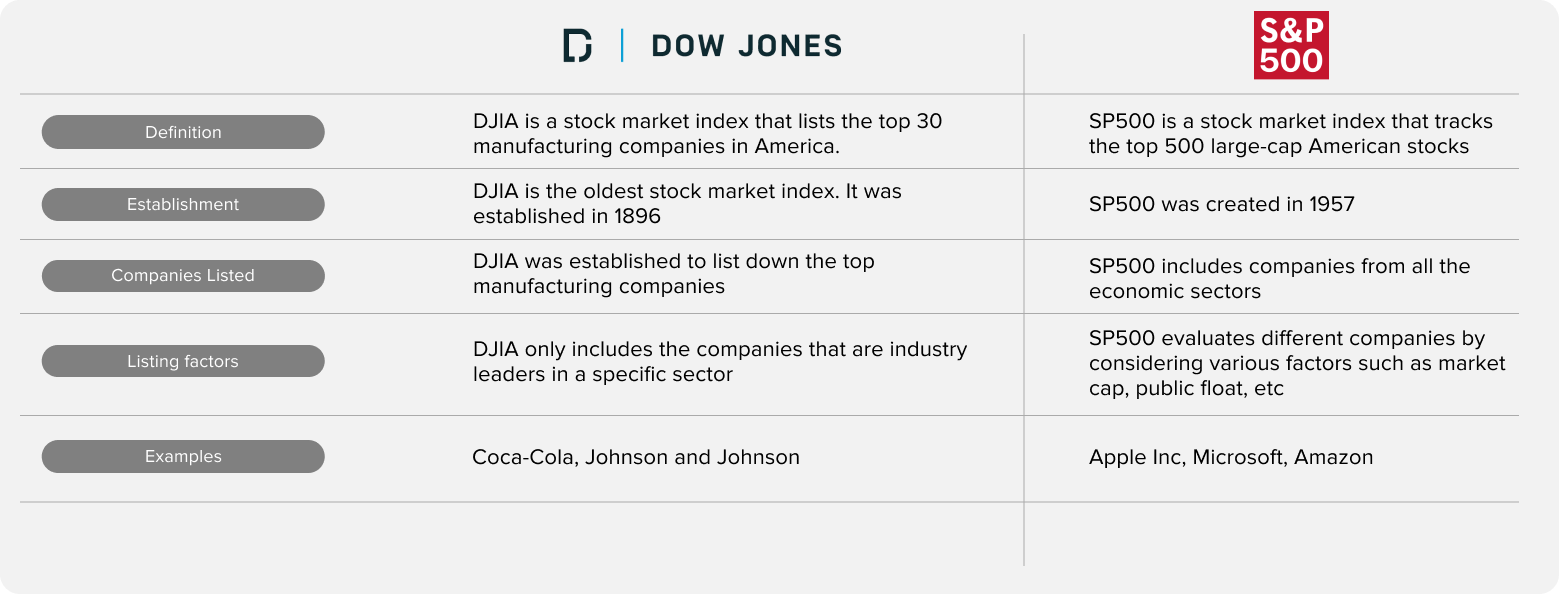

What is S&P 500?

The S&P 500, also known as the Standard & Poor's 500, is one of the best ways to monitor the stock market as it tracks the value of 500 corporations that have their stocks listed on the NYSE and the NASDAQ. Standard & Poors is a company that is well-known for creating financial market indices, which are widely used for investment benchmarks. The S&P is float-weighted, meaning the market capitalizations of the companies in the index are modified according to the number of shares available for public trading.

What are Key Takeaways of S&P 500?

- The S&P 500 index was developed in 1957 to help track the value of 500 large corporations who are listed on the NYSE.

- The S&P 500 today is influenced by rises and falls within the market, declining and rising during periods of economic uncertainty.

What are the Limitations of the S&P 500 Index?

One of the main limitations of this index is that it gives higher weights to businesses with more market capitalization, meaning that larger companies would have a greater influence on the index than smaller ones. This can lead to distortion as smaller companies, which generally see higher returns, are not shown as much as larger corporations.

What are the Competitors of the S&P 500?

One of the biggest competitors of the S&P 500 is the NASDAQ NOW, as these are two of the most popular equity indexes in the United States. While the S&P 500 is bigger and accounts for various businesses in different industries, the NASDAQ NOW only includes stocks that are traded on the NASDAQ, making it smaller with less representation when it comes to different industries.

What are the Key Differences Between the NASDAQ 100 and S&P 500?

One of the main differences between these two indexes is that the S&P 500 companies are broader, including more businesses from different industries and looking at more than one exchange. The NASDAQ 100 compares 100 companies that are traded on only the NASDAQ exchange and companies within the financial sector are not included on this list. Different investors prefer to use each of these indexes in different ways, though the

Baraka is regulated by the DFSA

Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.