Investing

Halal Stock List 2025

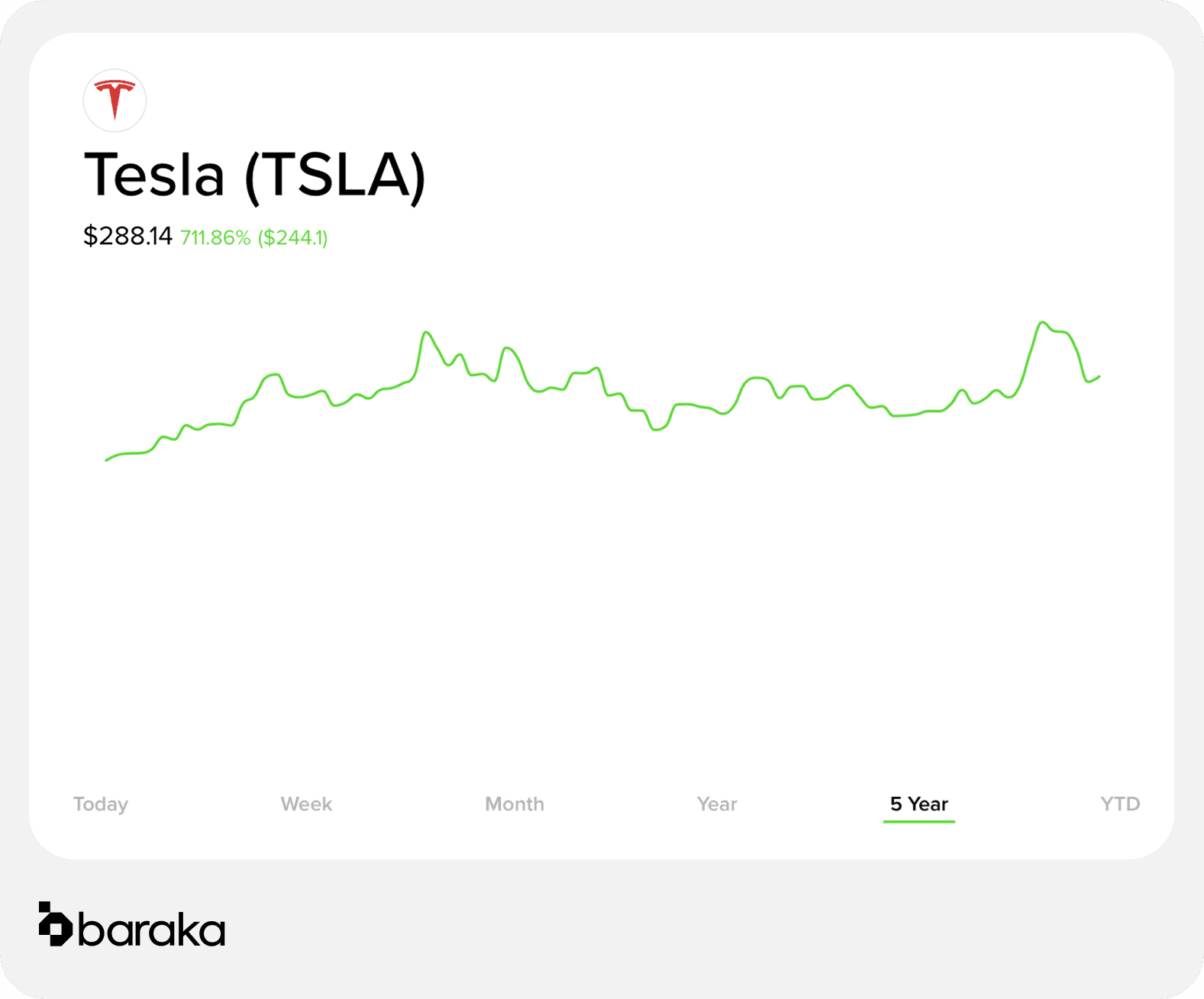

TSLA (TSLA)

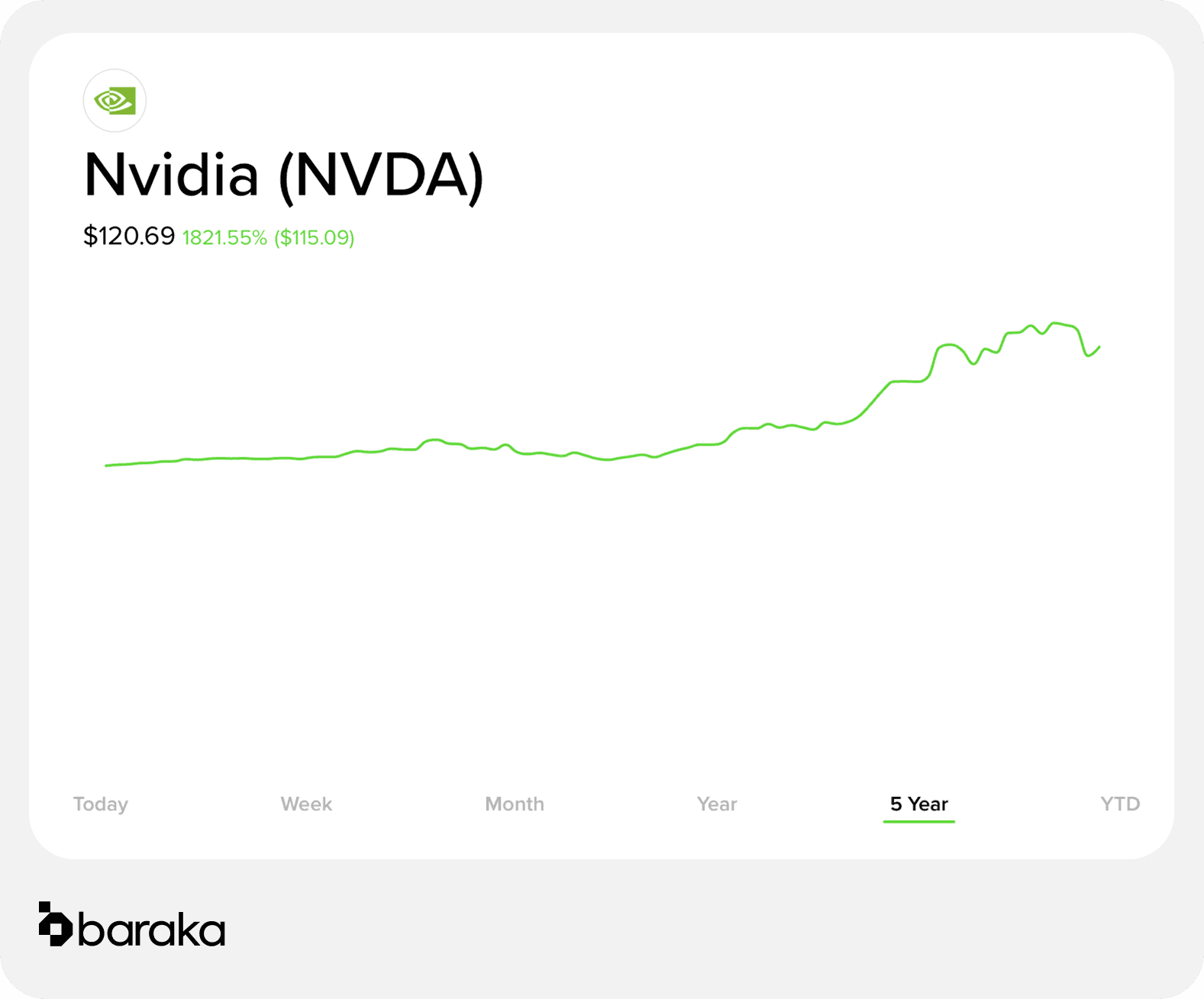

NVDA (NVDA)

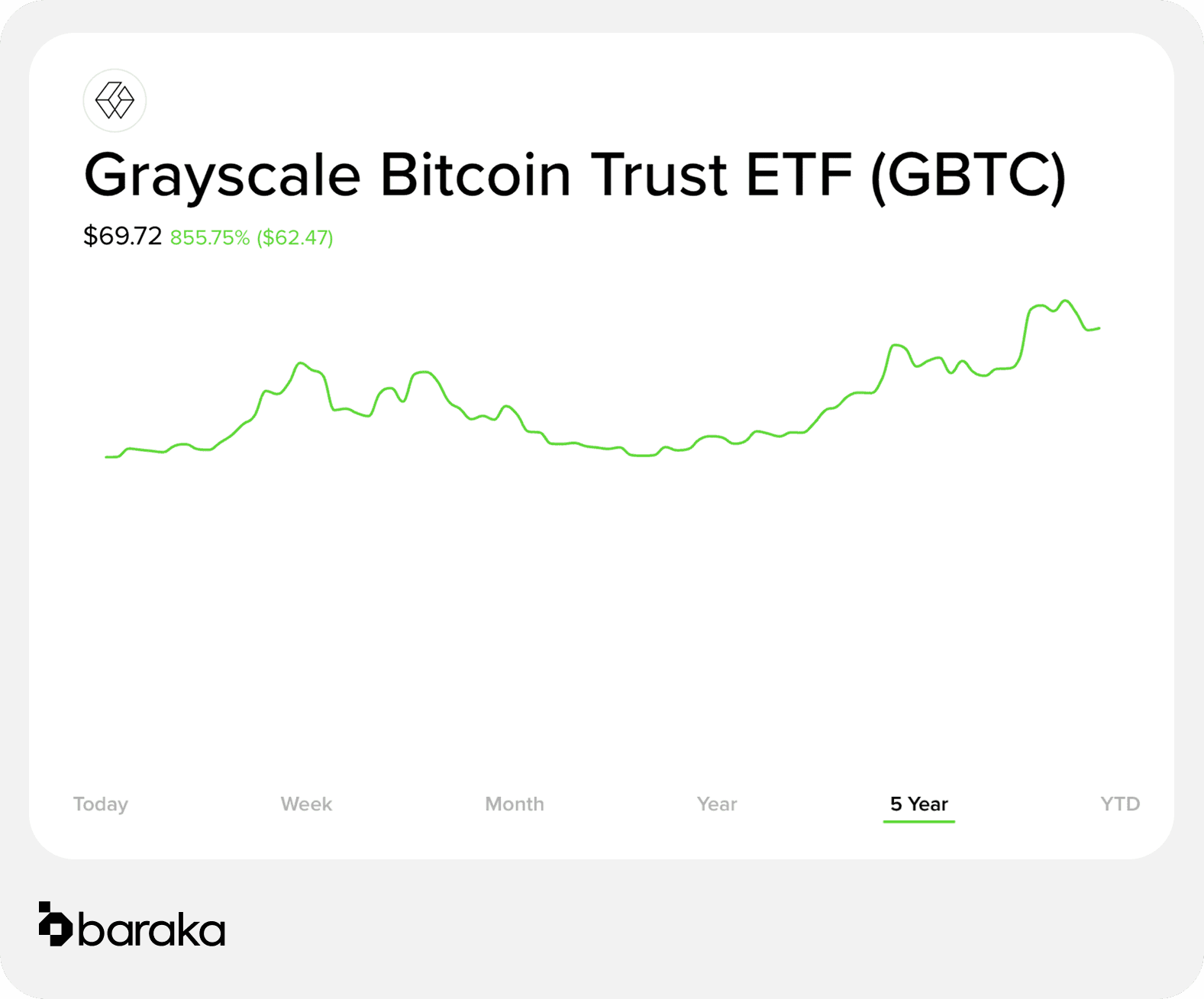

GBTC (GBTC)

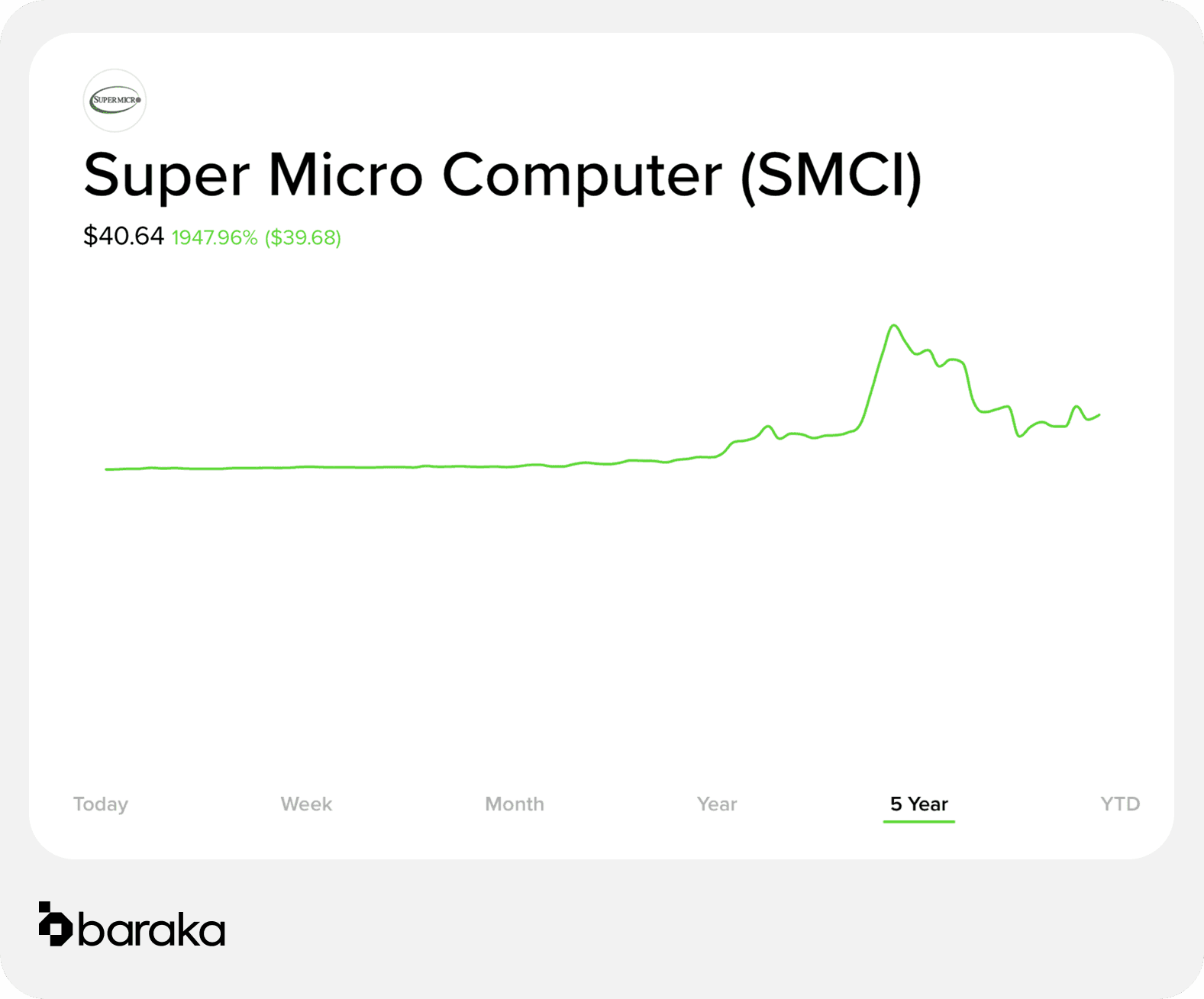

SMCI (SMCI)

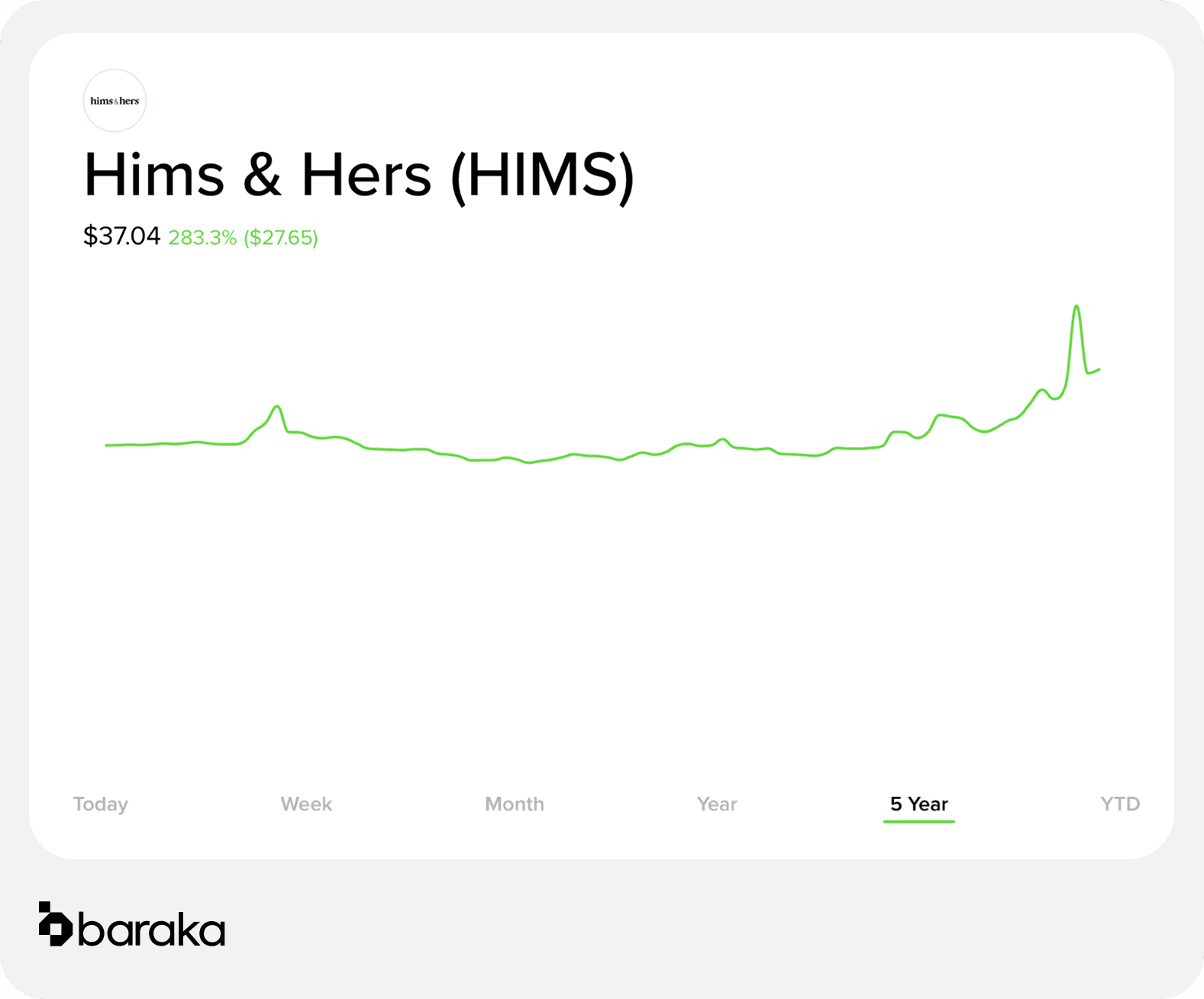

HIMS (HIMS)

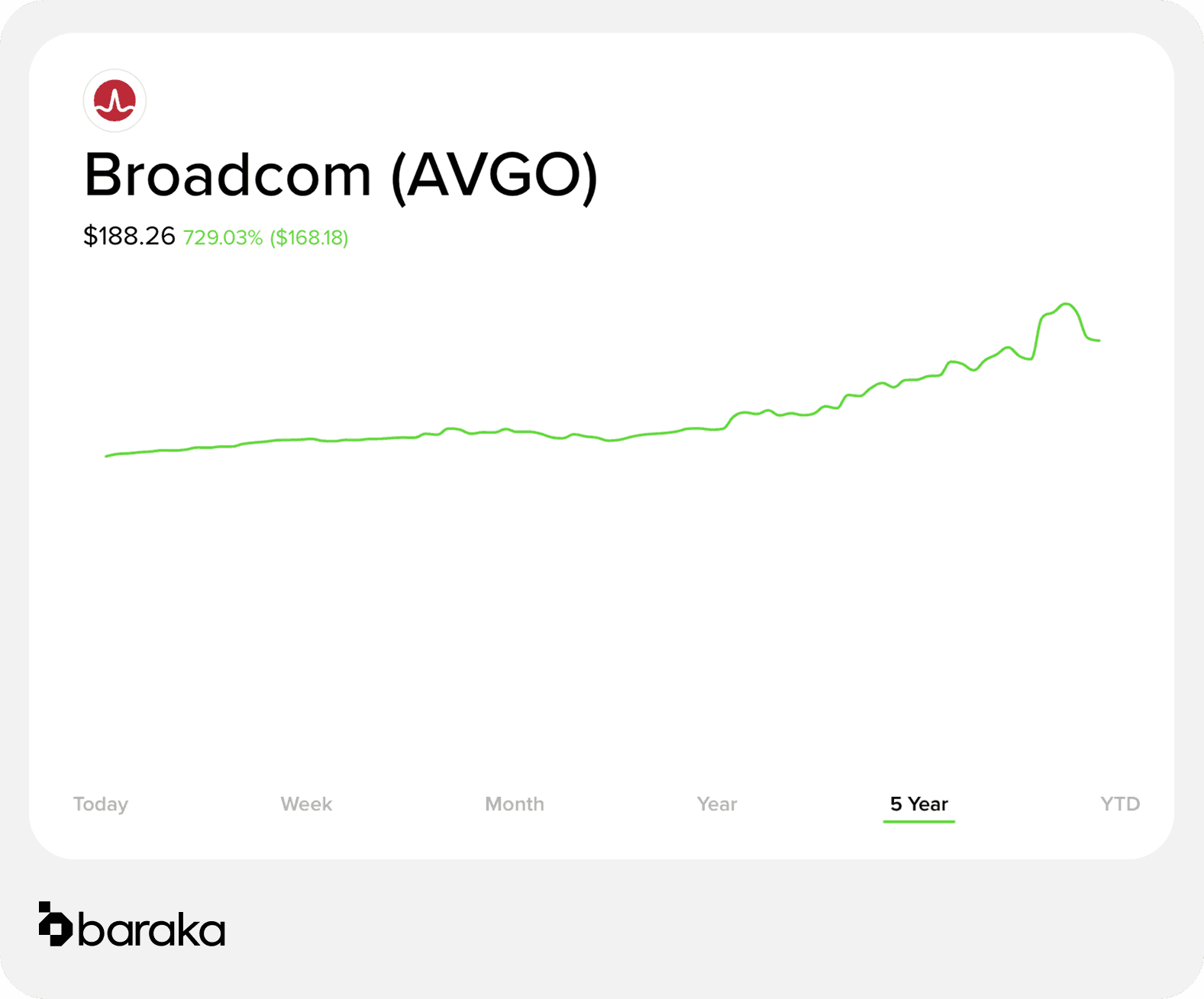

AVGO (AVGO)

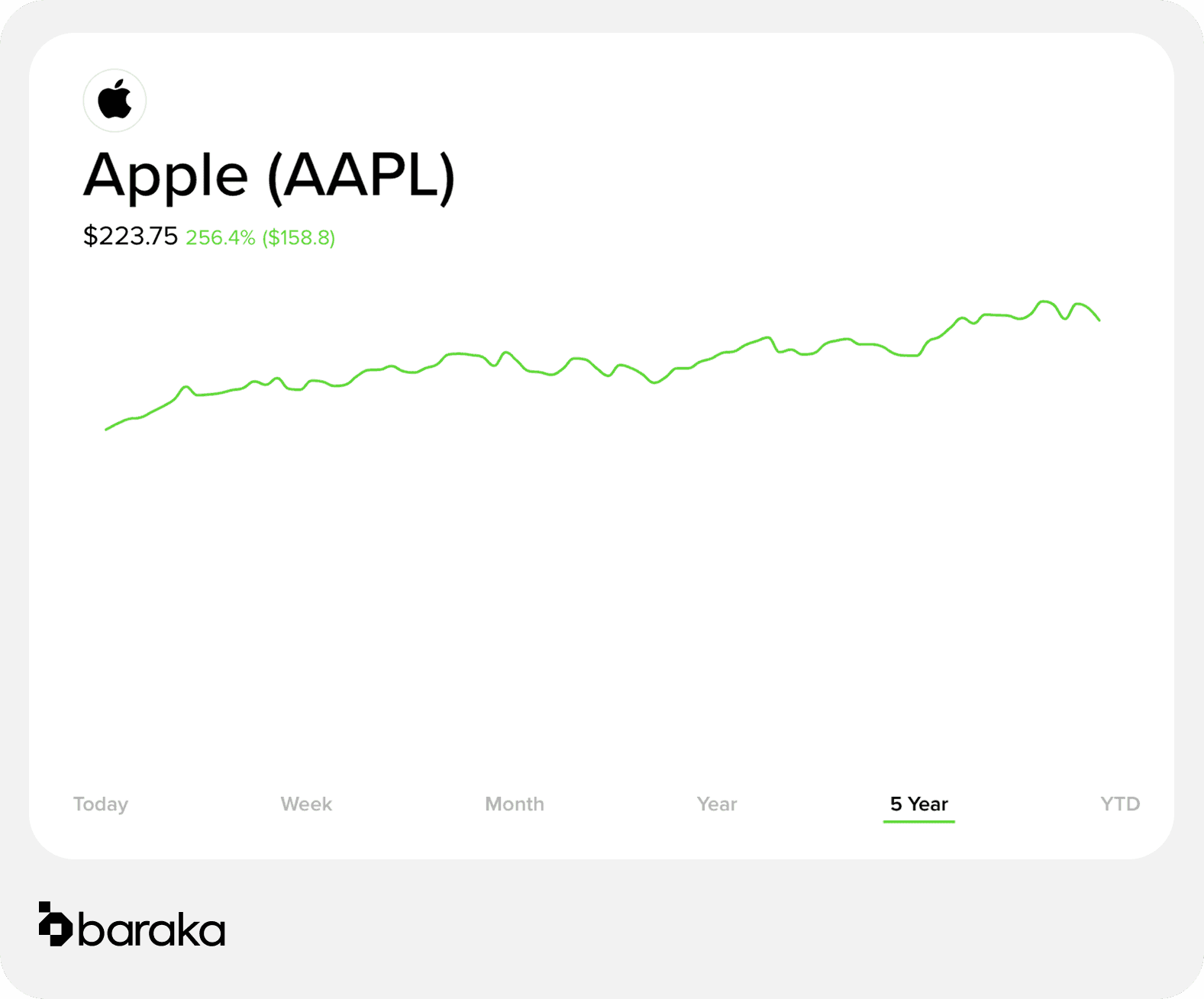

AAPL (AAPL)

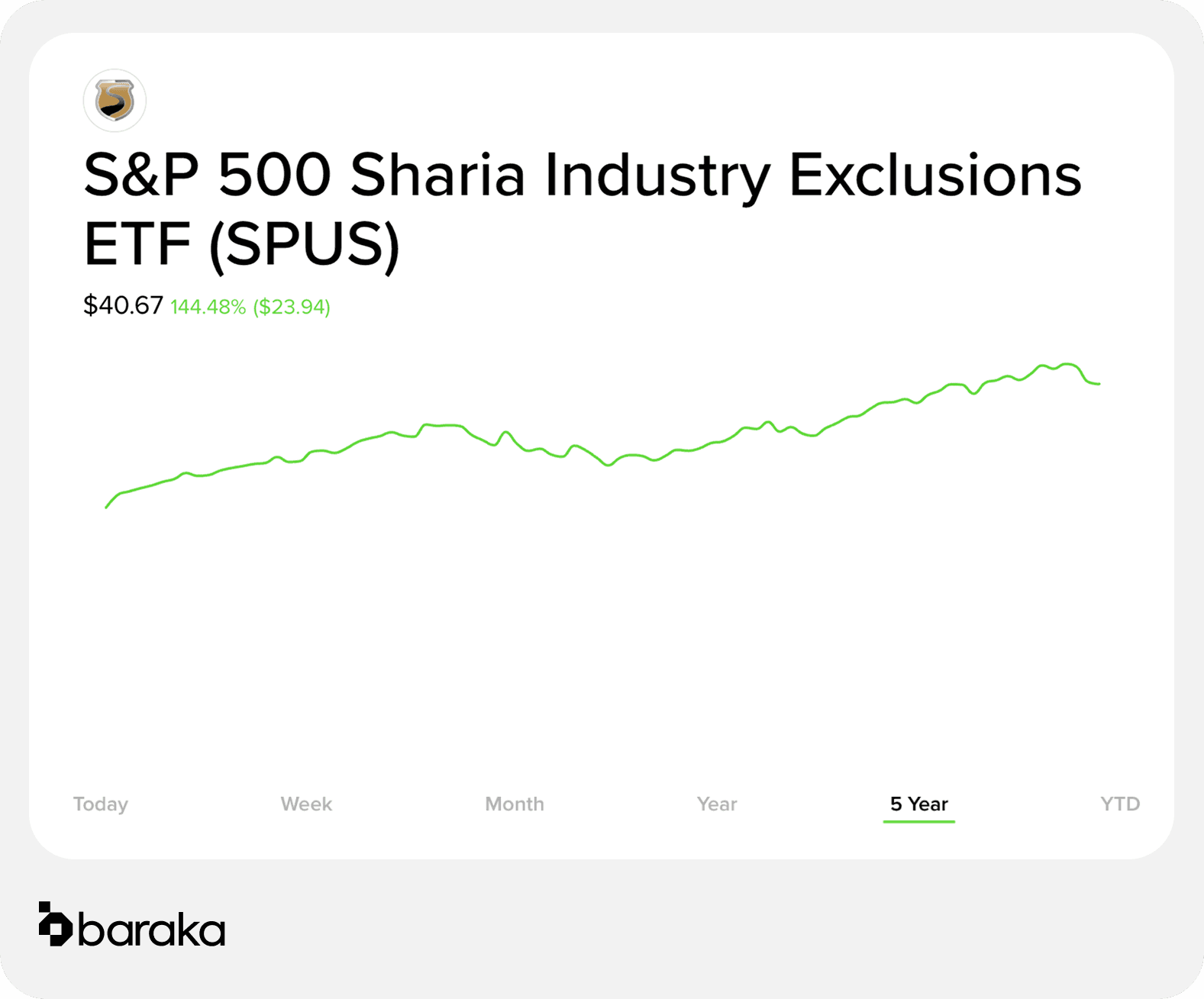

SPUS (SPUS)

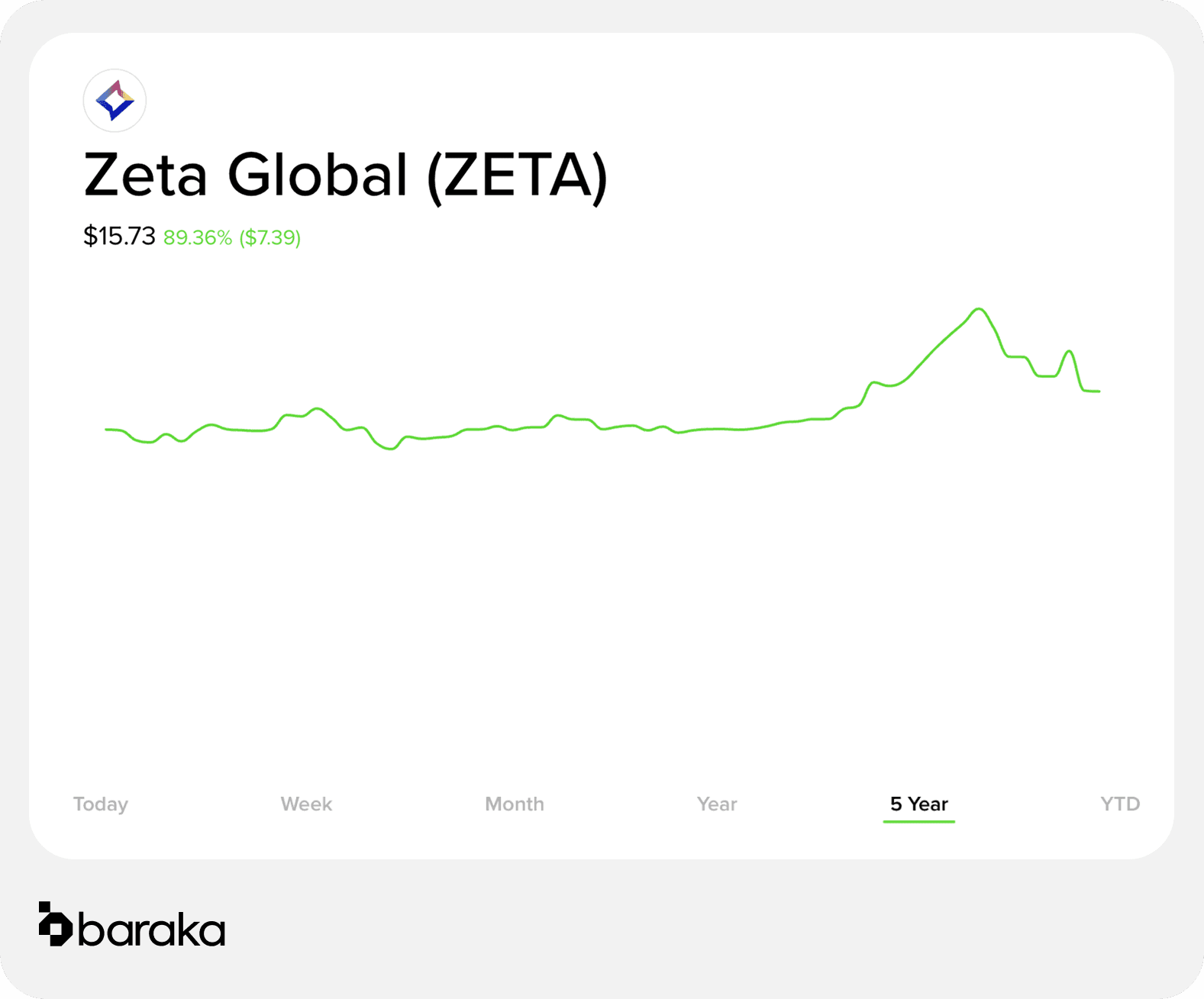

ZETA (ZETA)

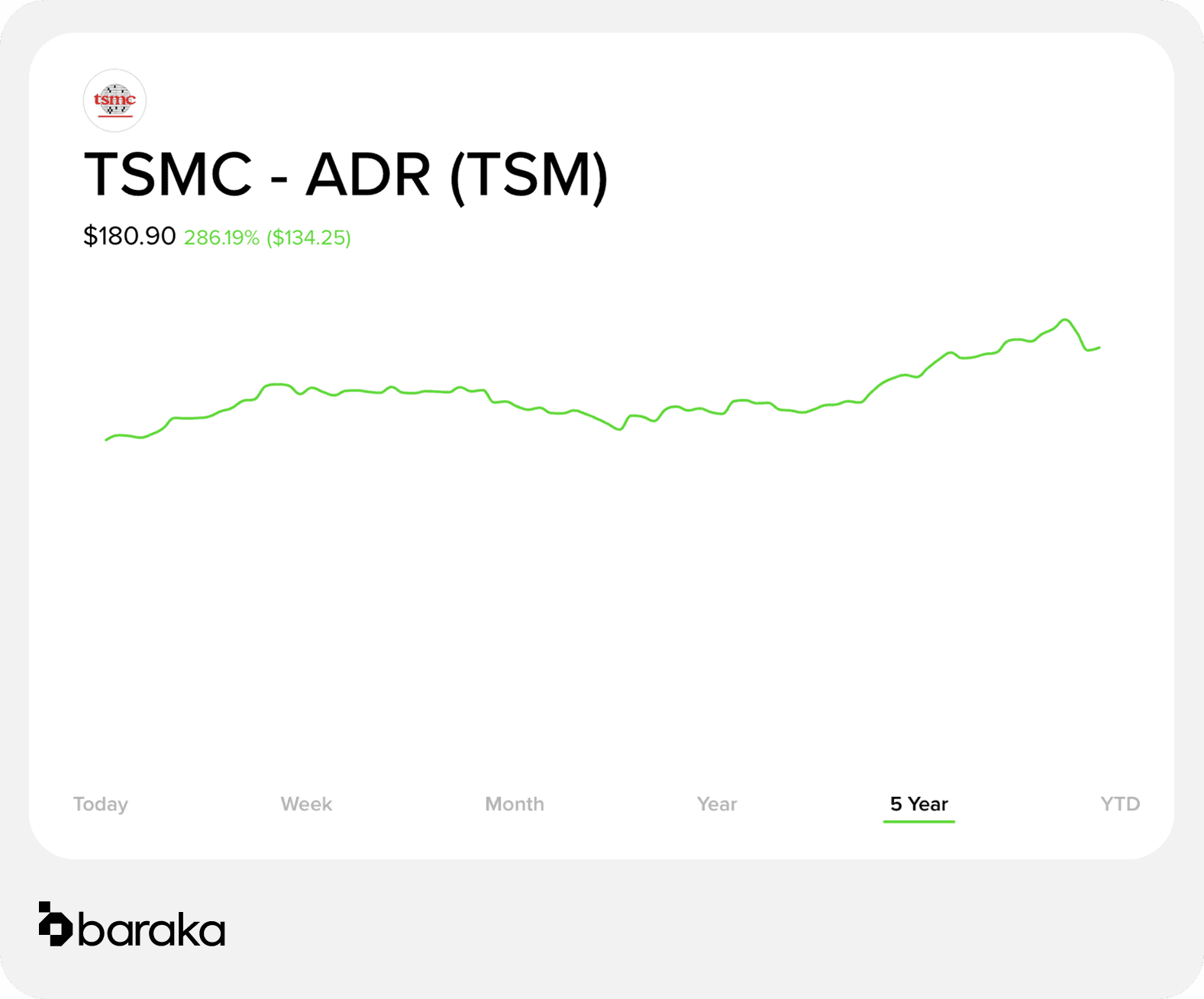

TSM (TSM)

Sharia-compliant stocks are stocks that follow the requirements of Shariah law and the principles of Islam. They are often recognized as a type of socially responsible investing.

Ethical and responsible investing is a topic that is becoming increasingly popular among investors as they consider their values and beliefs when making investment decisions. Globally, many investors are choosing to support companies that take environmental, social, and ethical factors into account, as well as those that promote corporate governance and shareholder advocacy.

Shariah-compliant investing not only appeals to Muslims but also provides socially responsible opportunities for people of other faiths. The main objective of Shariah-compliant investments is to provide an avenue for investors who wish to invest in a way that complies with Islamic law, governed in accordance with Sharia principles under the guidelines of the Sharia standard setting body, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

But what does that mean, exactly? Keep reading as we break down what Shariah-compliant investing is all about.

How to invest in US stocks in the UAE

What Is Sharia Compliance?

Sharia-compliant stocks are stocks that follow Islamic law.

A Shariah-compliant investment should not involve any of the activities prohibited by Islam, such as usury (Riba), gambling (Maisir), or ambiguity (Gharar). This includes investments in companies or sectors that are engaged in Shariah non-compliant activities, such as:

Institutions that deal with interest and excess debt

Alcohol

Pork-related products and non-halal food production, packaging and processing or connected activity

Gambling

Adult entertainment

Tobacco

Marijuana

Cloning

Firearms and defense

What Makes a Stock Halal?

Islamic scholars have established a screening process similar to "negatively screened" ethical funds using ESG criteria to determine whether a business activity abides by Shariah principles. Along with the screening process, a Sharia-compliant fund will include an advisory board made up of Islamic scholars who decide or check which companies meet the rules set out by AAOIFI. Each fund’s policies may differ as it is run in accordance with the Shariah Board's beliefs and interpretations. Investors should consult the fund's prospectus before investing.

The screening process involves the following stages:

Business activity screening

A business's activity must be in accordance with Shariah principles; therefore, any companies involved in the below activities are screened out:

Institutions that deal with interest and excess debt (non-Islamic banking, finance, and insurance, etc.)

Alcohol

Pork-related products and non-halal food production, packaging and processing or connected activity

Gambling

Adult entertainment

Tobacco

Marijuana

Cloning

Firearms, weapons, and defense

You can instantly rule out any businesses in these industries as they are engaged in Sharia-non-compliant activities. However, you can also dig deeper into how the company operates and if its practices are fair and ethical.

The most common mistake investors make is to invest in companies with interest-based income or companies that are lending at interest, as the generated income comes from Shariah-non-compliant investments.

If this applies to a stock that you are considering, there's a simple way to see whether the investment is still viable. The rule of thumb is that the revenue from these investments cannot exceed 5% of the gross revenue of the company. Investors should check income for Sharia-non-compliant investments and gross revenue from annual reports to verify this. You'll also want to compare this figure to the company's gross revenue. If it exceeds 5%, there are two generally permissible conditions.

The investor should first determine the amount of haram income received and offset it by giving away the same percentage of his profits to charity. Second, they should publicize their opposition to these haram activities in some manner.

Financial Ratio Screening

Once the companies with non-compliant business activities have been screened out, they are further reviewed using accounting ratios.

The second factor for a stock to be considered halal relates to the percentage of interest-bearing debt in relation to total assets. Interest-bearing debt must not exceed 33% of total assets. This benchmark is not specific to halal investments, non-muslim investors also use similar rules as it’s a comfortable level of risk.

A company would be acceptable for Sharia-compliant investments if it meets the following criteria:

Interest-bearing securities and assets must be less than 30% of trailing 36-month average market capitalization

Interest-bearing debt must be less than 30% of trailing 36-month average market capitalization

If it exceeds the percentage allowed, the company or investment will be considered Shariah non-compliant.

Top 10 Halal Stocks List of 2025

Below is a list of some of the most traded halal stocks on the baraka app for the year 2025.

1 – Tesla (TSLA)

Tesla, Inc. is an American electric vehicle and clean energy company based in Palo Alto, California. It designs and manufactures electric cars, battery energy storage, solar panels, and related products.

Market Cap: $804.1 billion

Performance (YTD): 5.6%

Sharia Score: 3

2 – Nvidia (NVDA)

NVIDIA Corporation is an American multinational technology company headquartered in Santa Clara, California. It designs and manufactures graphics processing units (GPUs) for gaming and professional markets, as well as system-on-a-chip units (SoCs) for mobile computing and automotive markets.

Market Cap: $3 trillion

Performance (YTD): 8.9%

Sharia Score: 3

3 – Grayscale Bitcoin Trust (GBTC)

Grayscale Bitcoin Trust is an investment vehicle that enables investors to gain exposure to Bitcoin without the challenges of direct cryptocurrency ownership. It holds Bitcoin and issues shares reflecting its value.

Market Cap: Approximately $10.5 billion

Performance (YTD): 15.2%

Sharia Score: 2

4 – Super Micro Computer, Inc. (SMCI)

super Micro Computer, Inc. is an American information technology company based in San Jose, California. It specializes in high-performance server technology, including servers, storage systems, and management software.

Market Cap: $25 billion

Performance (YTD): 12.3%

Sharia Score: 4

5 – Hims & Hers Health, Inc. (HIMS)

Hims & Hers Health, Inc. is an American telehealth company offering a modern approach to health and wellness. It provides access to medical professionals and treatments for various conditions through a digital platform.

Market Cap: $7.1 billion

Performance (YTD): 3.7% Sharia

Score: 4

6 – Broadcom Inc. (AVGO)

Broadcom Inc. is an American designer, developer, and global supplier of a wide range of semiconductor and infrastructure software products. Its products serve data center, networking, software, broadband, wireless, and storage markets.

Market Cap: $919.49 billion

Performance (YTD): 4.5%

Sharia Score: 3

7 – Apple (AAPL)

Apple Inc. is an American multinational technology company headquartered in Cupertino, California. It designs, manufactures, and markets consumer electronics, computer software, and online services, including the iPhone, iPad, Mac, and Apple Watch.

Market Cap: $3.2 trillion

Performance (YTD): 7.1%

Sharia Score: 1

8 – SP Funds S&P 500 Sharia Industry Exclusions ETF (SPUS)

SPUS is an exchange-traded fund that seeks to track the performance of the S&P 500 Sharia Industry Exclusions Index. It invests in companies within the S&P 500 that meet Sharia compliance standards, excluding those involved in industries like alcohol, gambling, and interest-based finance.

Market Cap: $100 million

Performance (YTD): 2.9%

Sharia Score: 5

9 – Zeta Global Holdings Corp (ZETA)

Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Market Cap: $3 billion

Performance (YTD): 31.37%

Sharia Score: 3

10 – Taiwan Semiconductor Manufacturing Company Limited (TSM)

TSMC is a Taiwanese multinational semiconductor contract manufacturing and design company. It is the world's largest dedicated independent semiconductor foundry, providing advanced chip manufacturing services.

Market Cap: $550.2 billion

Performance (YTD): 6.8%

Sharia Score: 4

How to Buy Halal Stocks with baraka?

At baraka we offer users the chance to Halalify their portfolios through our Sharia filter, allowing them to invest in stocks and ETFs without compromising their personal beliefs.

baraka provides access to traditional securities and does not intend to engage a Shariah advisor or obtain a fatwa regarding Sharia-screened securities listed on the app. Baraka does not have an Islamic Window endorsement from the DFSA. Clients should be aware that Sharia-screened stocks may involve additional risks and costs. There can be no assurance as to the Sharia compliance of the securities listed by Baraka Financial Limited. Clients are reminded that views on Sharia compliance may also differ. If you do not understand such risks or costs or are unsure whether the securities offered by Baraka Financial Limited are in compliance with the principles of Sharia, you should consult a Sharia advisor.

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.