A Dividend Reinvestment plan, commonly referred to as DRIP, is an investment plan that allows investors to buy shares directly from a company using the dividends they’ve earned from it.

Understanding DRIP

Dividend investing is a popular way to generate income and save for retirement. When investors purchase shares in a company they often receive a dividend reward, which is a portion of their earnings, received in the form of a cash payment to their brokerage account.

Investors can choose to save their dividends, invest them or spend them as regular income. Instead, some investors choose to reinvest the cash back into the stock to purchase more shares. A Dividend ReInvestment Plan (DRIP) enables investors to automate the reinvestment process. If some Brokerages may enable you to automatically reinvest dividends in an automated way, otherwise you need to manually process the new investment Here’s a basic example of how a DRIP works, imagine you have 200 shares of a company that pays out a $0.50 per share dividend. When the company pays out its dividends, you’ll receive $100 (200 shares x $0.50).

Suppose that when you receive the dividend, the market price of the stock is $10 per share. Instead of receiving the $100 cash, you would receive an additional 10 shares of the stock instead.

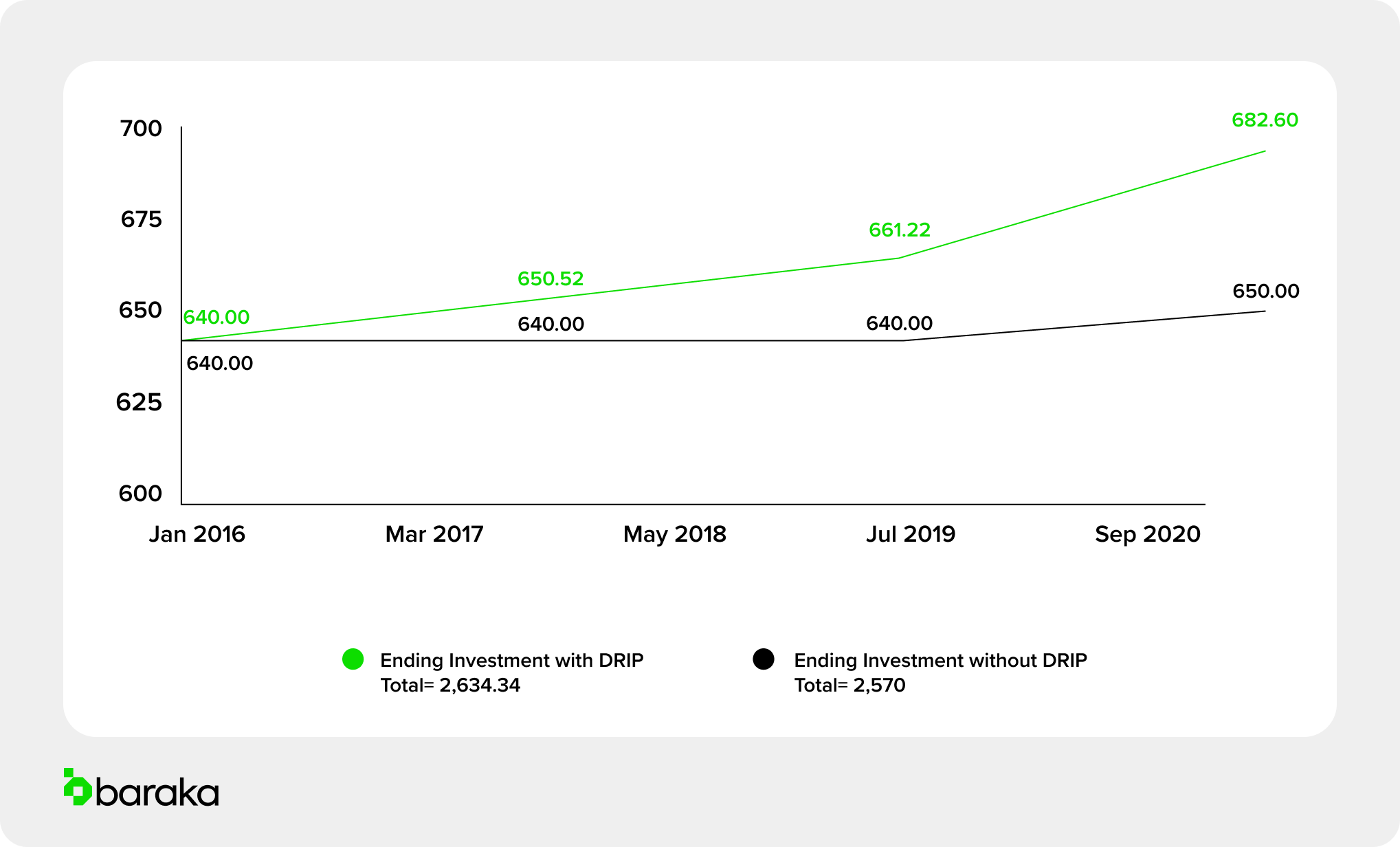

Why do people use DRIPs? Well, because there’s a general belief that reinvesting compounds returns over time. Read on to learn more.

Advantages of a Dividend Reinvestment Plan

- DRIPs help you take advantage of dollar-cost averaging investing. Dollar-cost averaging involves investing the same amount of money in an investment on a regular schedule, rather than putting all your money into an investment all at once. This can help lower your average cost per share and increase your returns over time.

- Automatic Reinvestment: DRIPs enable you to reinvest dividends into additional shares of the same stock, which can help reduce the chance that you'll leave cash sitting uninvested if you forget to manually reinvest it.

- Dividend reinvestment plans are an excellent way to generate additional compound returns. Investment returns compound over time, and when you reinvest your dividends, you provide yourself with even more compounded growth.

Disadvantages of a Dividend Reinvestment Plan

- Diversification: If you choose to set up a DRIP plan with one stock, over time you could accumulate a significant amount of that particular stock and reduce your diversification. You'll also increase your risk to that single investment considerably.

Real-World Example of a DRIP

An investor owns 1,000 shares of Verizon priced at $38.92 per share and decides to set up a dividend reinvestment plan. Verizon declares a dividend of $0.65 per share, which means if the investor owns 1,000 shares of Verizon, he would’ve received $650 in cash if they were not enrolled in the dividend reinvestment plan. However, if they did enable DRIP, they would receive an additional 16.7 (Cash Dividend Amount / Share Price = 650 / 38.92) shares of Verizon.

baraka’s DRIP Feature

If you like what you're reading and are ready to implement DRIP into your strategy, you can do so from the baraka app. Many investors find it helpful to start DRIPs with investments they already own and like. That is if you already have several companies in your portfolio.

With the touch of a button, you can arrange access to an automatic investment plan (DRIP) with baraka and choose which dividend-yielding stocks you want to reinvest dividends into and which ones you want to collect dividend cash payments from instead.

Just follow these steps:

- Go to settings, click features and turn on Dividend Reinvestment Plans – non premium features

- Toggle on and off stocks of your choice – premium

Baraka is regulated by the DFSA