Around the world, there are 60 major stock exchanges ranging in size and volume from small to large. Out of the 60 the US stock market is the largest and is home to thousands of securities, hosting some of the most sought-after American companies such as Apple (APPL,$), Amazon (AMZN,$), Meta (META,$) and many more.

We know buying your first stock can be an intimidating process, especially when you don’t know where to start. However, despite your level of investing experience, if you are looking to start your investment journey, the US market can be a good starting point to explore some of the world's most successful companies. This article will help you get started investing in the US stock market.

How to Invest Money In the UAE

Can I buy US stocks from the UAE?

Although the stock markets are regulated by US law, you do not have to be a US citizen to trade in these markets, meaning that you can buy US shares while being a resident in the UAE. There are no laws prohibiting non-US citizens from investing in US markets such as the New York Stock Exchange or Nasdaq.

How to buy US stocks in the UAE 2024

As a self-directed investment platform, we at baraka are always working to empower the next generation of investors across the GCC by making investing accessible to everyone.

Our investment platform gives users access to over 6,000 US-listed securities, including stocks, Exchange Traded Funds (ETFs) and fractional shares with no minimum investment requirements.

Once you have created a baraka account and completed your onboarding, you will unlock an intuitive investment interface where you can buy stocks at the click of a button and monitor all your investment activity.

How to buy and sell US stocks from the baraka app step by step.

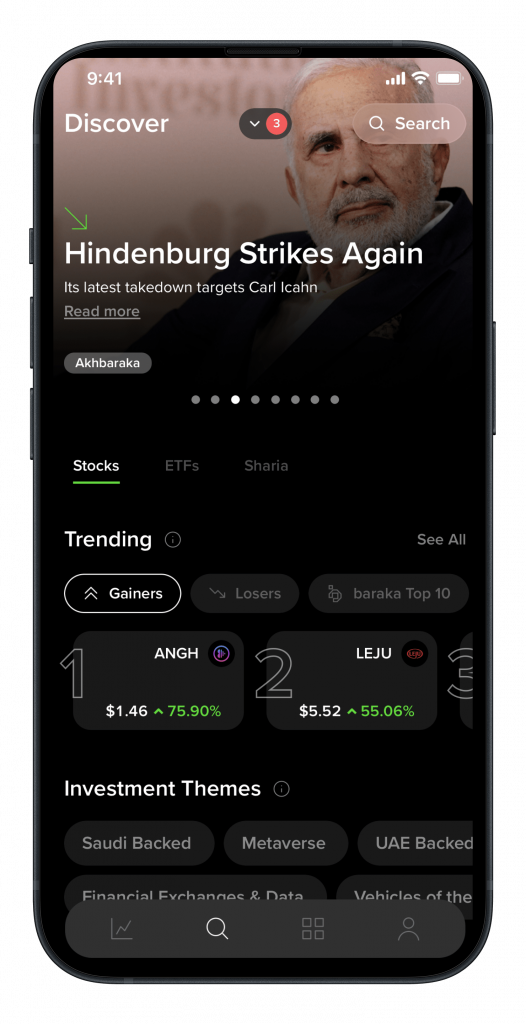

1. Search for the stock or ETF from our discovery page

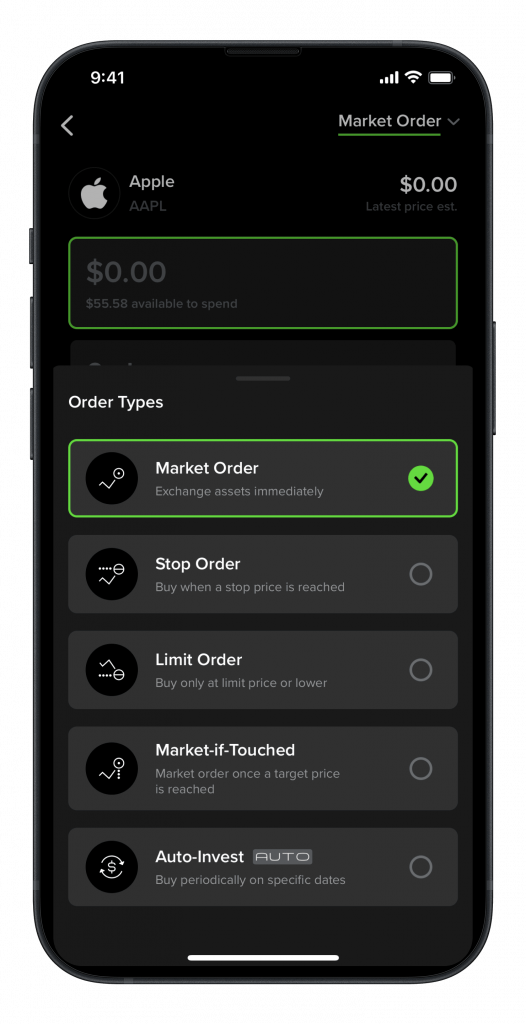

2. Choose the type of buy order

Once you have selected the security select the ‘invest’ button, you will see 5 buy order options.

- Market Order: Market orders are executed at the going asking prices for security in the market.

- Stop Order: Stop loss orders are essentially limit sell orders for the stocks you hold in your portfolio, set at a price below the current market price. This is the price at which you would sell the security.

- Limit Order: Limit orders are placed by investors keeping a target buy or sell price in mind.

- Market-if-Touched: A market-if-touched (MIT) order becomes a market order when a stock trades at its specified price.

- Auto-Invest: allows you to automatically invest in stocks and ETFs on the baraka platform bi-weekly, monthly and quarterly.

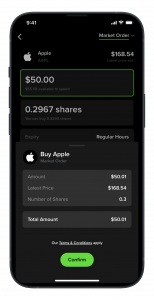

3. Confirm your order

After placing your order you will have the option to review the buy or sell order to ensure there are no mistakes.

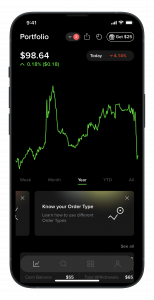

4. Monitor Performance

Once you've purchased a stock or ETF, you can monitor your investment in your portfolio page and through our Watchlist feature. We know that there may be a few stocks you'd like to keep track of pre- and post-purchase, which you can do all in one place. Creating a watchlist allows you to monitor and track as many hand-picked stocks and ETFs as you like—you can create different lists for different purposes too.

Unlock your Knowledge

To drive financial inclusion across the MENA region we focus on creating quick bite-sized engaging content. As we don’t offer any investment advice we value educating our users. In order to achieve this we have created the ‘learn academy’ which educates users on investing principles by learning and testing their understanding and our premium product offers users access to equity research reports on specific securities.

Baraka is regulated by the DFSA

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.